¶ Basics of borrowing on Sovryn

Sovryn allows you to borrow specific assets using your funds as collateral. You can participate in collateralized borrowing without relinquishing your collateral assets to a third-party custodian. Sovryn is a decentralized finance platform that requires no permissions and will never take custody of your coins. The platform offers core features like borrowing that can elevate decentralized finance for Bitcoin to a whole new level.

¶ Types of borrowing on Sovryn

Sovryn offers two types of borrowing:

- fixed-interest loans: This is a more traditional type of loan in which lenders deposit various assets and borrowers are able to borrow them with other assets as collateral. Borrowers pay a fixed rate of interest that compensates lenders for making their funds available.

- zero-interest loans: This type of loan charges no interest but levies an origination fee for the loan. The loan is issued by minting new DLLR stablecoins, which are backed by a peg mechanism to be worth at least 1 USD per DLLR in BTC.

The first type of borrowing is documented here. You can also learn about how zero-interest loans work or learn how to take out a zero-interest loan.

¶ Mechanism

When you borrow on Sovryn, your loan is issued from assets provided by lending pool participants. The APY (annual percentage yield) is the interest rate you pay on your loan. This value changes according to the demand and supply for borrowing. Interest payments are made by borrowers in the asset borrowed, not the collateral asset. Borrowed funds are overcollateralized by borrower assets locked in a smart contract. The arrangement is entirely non-custodial. These collateral assets are subject to automatic liquidation (with a penalty) if the collateral ratio falls below a threshold. You may pay back your loan at any time. When available funds (funds that are still in the lending pool and available for borrowing or withdrawal) are in short supply, the system sets the interest rate progressively higher to discourage borrowing and encourage lending. When liquidity for borrowing is abnormally low, the system will raise interest rates dramatically to reward lenders and encourage borrowers to pay off their loans.

¶ Terms of the loan

- Loans are initially for 28 days. The interest is paid for this period in advance. The deposited collateral is held by the protocol when you take out a loan.

- A 150% collateral ratio—the ratio of collateral value to loan value—is required to open a loan (300% if SOV is collateral). The collateral is used to secure the loan from price fluctuations and to collateralize further interest payments if the loan is rolled over. If the collateral ratio falls below 115%, your loan is subject to a liquidation process.

- Interest for the initial duration is included in the amount borrowed.

- If you repay the debt before the current end date, you will get a refund of the prepaid interest for all remaining days as well as all the deposited collateral minus the loan origination fee (0.09%).

- If you don't repay the loan before the end date or extend the loan yourself, the loan rolls over for a month (365/12 days) at the same fixed APY and all prepaid interest is distributed (90% to lenders, 10% protocol). You are charged 0.1% of the loan value for the service of automatically rolling over your loan. The current loan is then extended for a month. However, your collateral ratio is now lower because you have paid the fees for the previous period plus the rollover fee and are prepaying interest for the new period.

¶ Liquidation process

When the value of your deposited collateral falls below 115% of the debt, a gradual liquidation of the collateral is initiated. The process liquidates the amount of collateral required to bring your collateral ratio back up to 120%. The liquidator repays a portion of your loan and receives an equivalent value of your collateral at a 5% discount for performing the liquidation service. (Note: This works out to approximately 33% of your loan being repaid but 41% of your collateral being claimed, so this is a situation that borrowers will want to avoid.) This process will repeat over and over if the value of your collateral continues to decline relative to the loan value. This gradual liquidation can result in the complete depletion of your deposited collateral.

This process:

- protects lenders by transferring the borrower's collateral to the lender if a loan is unpaid.

- incentivizes borrowers to maintain sufficient collateral to cover their loans.

For information about repayment deadlines, go to the Borrow page and check the MY DEBTS→Payback until field at the bottom of the page.

¶ Borrowing rate

The borrowing rate is determined by the utilization rate of the lending pool. The lending rate and borrowing rate vary as the utilization rate of the lending pool changes. The borrowing rate will increase gradually until the protocol reaches 75% pool utilization. When more than 75% of the pool is being utilized, the borrowing rate increases significantly to discourage borrowing.

The system is designed to reduce the borrowing rate when it is too high by increasing the interest rate. This encourages more people to lend to the pool in return for high interest, thereby reducing the utilization rate and the borrowing rate.

The borrowing rate displayed on the dapp is the minimum interest the next borrower will have to pay. It is a function of current utilization rate of the lending pool. Since not all borrowers pay the same interest, the average interest all borrowers have to pay is distributed uniformly to lenders through LP (liquidity pool) tokens based on the utilization rate of the pool. For example, if average interest rate all borrowers are paying is 10% and utilization rate of the lending pool is 50%, then each LP token will receive 5%.

¶ Reference

¶ Borrow

Note that you can only borrow DLLR and BTC on the dapp. You can borrow all assets on the alpha dapp.

¶ 1. Access the dapp

- Go to https://sovryn.app to access the dapp.

¶ 2. Get started

- On the top-right of the screen, click the Get Started button to connect your wallet, and follow the on-screen instructions. If you have not already set up your wallet to connect with the Sovryn dapp, visit the Wallet Setup Guide section before proceeding further.

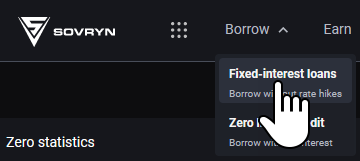

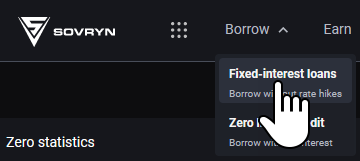

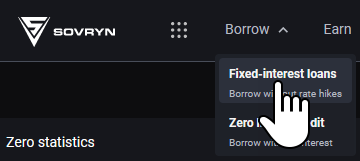

¶ 3. Select Borrow → Fixed-interest loans

- From the top navigation menu, select the Borrow tab and then the Fixed-interest loans option.

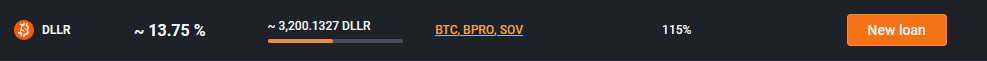

¶ 4. Select the asset to borrow

- Select the asset you would like to borrow. The graphic below uses the DLLR asset as an example.

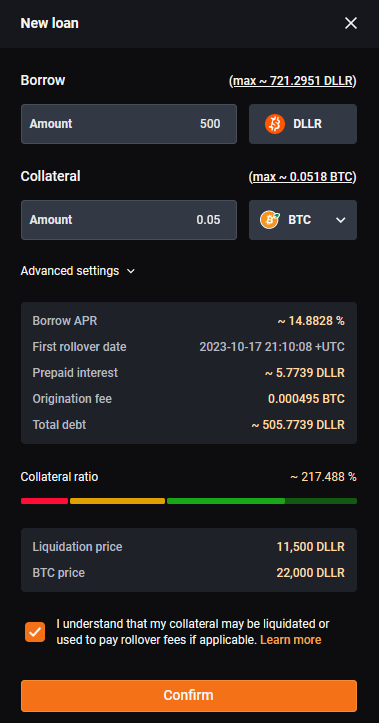

¶ 5. Enter the amount to borrow

- Enter the amount you want to borrow in the Amount field.

- Read and check the terms of the loan after having read the “Basics of borrowing on Sovryn” section.

- Note: Clicking Advanced settings allows you to specify an initial loan period that is shorter than the default 28 days.

- Double-check your selections and click the Confirm button.

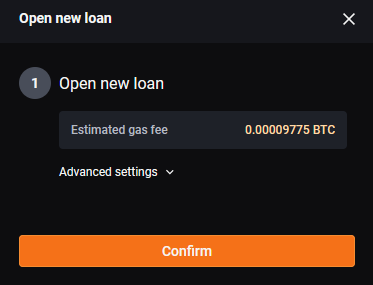

¶ 6. Confirm your transaction

You will be shown a new loan summary. Check your selections and then click the Confirm button.

You will be prompted by your wallet to confirm the transaction.

- Confirm the borrowing process using your wallet.

Please be advised that the current transaction fees should be in the range of 0.065 GWEI.

Congratulations! You have successfully borrowed funds from the Sovryn lending pool.

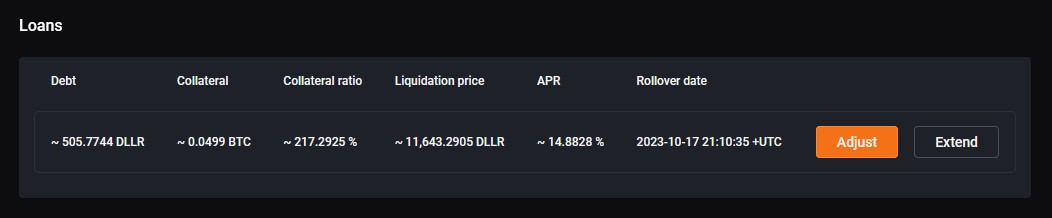

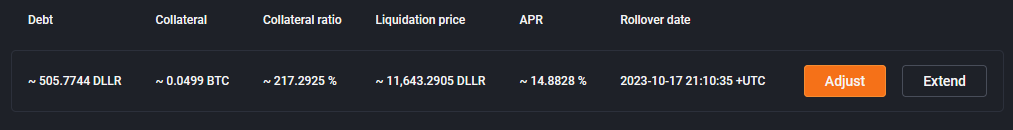

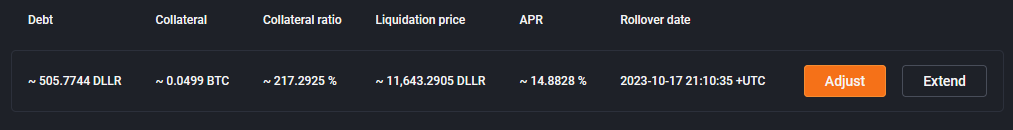

¶ 7. Overview

Your Borrow status can be viewed on the Borrow page, showing each detail of every loan position you have. You can also use this to Adjust the balance of your loan by either adding or withdrawing collateral or repaying some or all of the loan. You can also Extend the loan to a new rollover date.

¶ Borrow on the alpha dapp

Note that you can also borrow DLLR and BTC on the newer dapp.

¶ 1. Access the Sovryn Alpha dapp

- Go to https://alpha.sovryn.app to access the dapp.

¶ 2. Connect your wallet

- On the right top, connect your wallet by clicking the Connect Wallet button.

If you have not already set up your wallet to connect with the Sovryn dapp, visit the Wallet Setup Guide section before proceeding further.

¶ 3. Select Finance → Borrow

- From the top navigation menu, select the Finance tab and continue with the Borrow option.

¶

Borrowing APY%

- The Borrow APY is the Loan Percentage Rate (interest) that you will pay for borrowing the selected asset.

- This is entirely a non-custodial arrangement with no prepayment penalties, so you are free to fully repay the borrowed asset at any time. Sovryn is a trusted platform for borrowing.

- The APY is variable according to the demand for borrowing on the Sovryn platform.

- Interest payments made by borrowers are distributed to lenders and SOV stakers.

¶

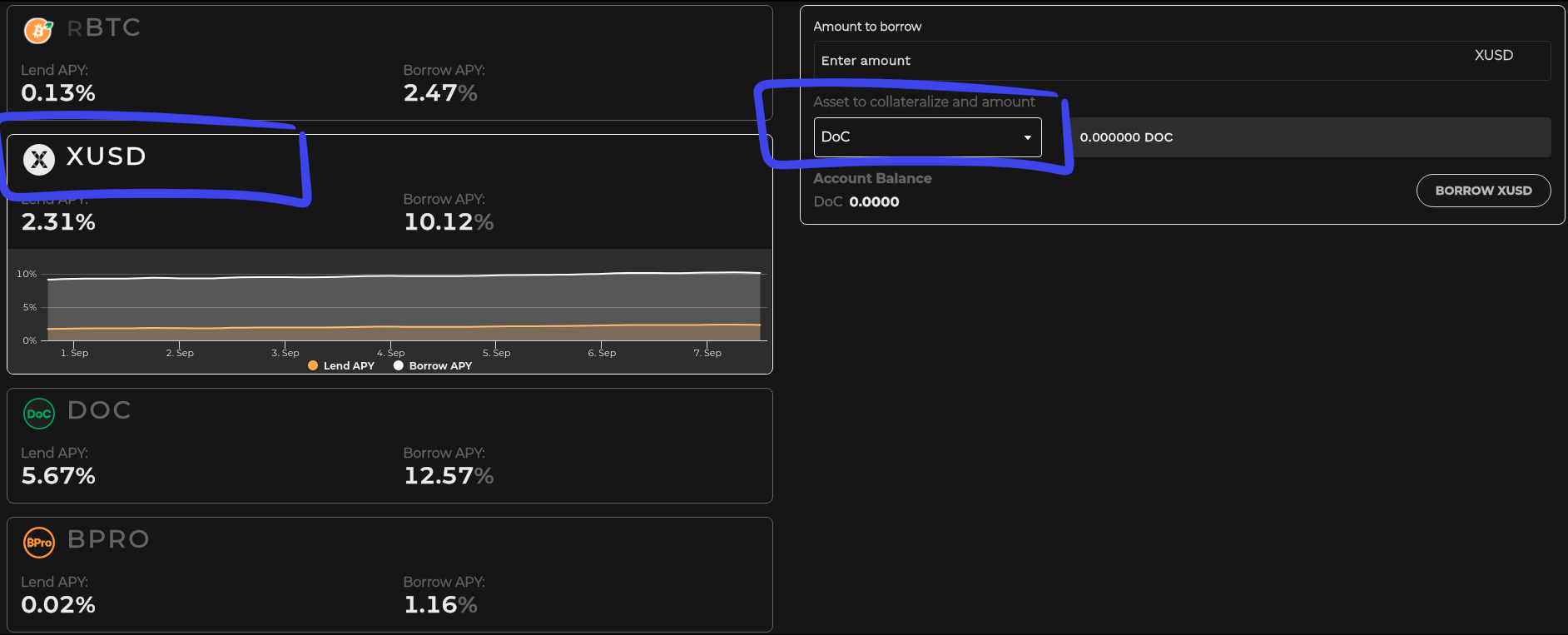

4. Select the asset to borrow

- Select the asset you would like to borrow using the left panel. Options are:

- RBTC

- XUSD

- DOC

- BPRO

Once you select the desired asset in the left panel, it will show a chart of APY for the most recent week.

¶

5. Enter the amount to borrow and select the source of collateral

- Enter the amount you want to borrow in the Amount to borrow field.

- Select the asset you currently hold that you want to use as collateral from the “Asset to collateralize and amount” drop-down.

- The dapp displays the amount needed for collateral. This amount updates based on market fluctuations. The dapp also displays the current collateral Account Balance under the collateral asset chosen.

- Double-check your selections and click the Borrow [name of the asset] button in the right bottom corner.

¶

6. Approve & Confirm your transaction

You will be prompted by your wallet to perform approval and confirmation.

- Confirm the borrowing process using your wallet.

Please be advised that the current transaction fees should be in the range of 0.065 GWEI, where the number of gas units used can vary in a range from 900K to 1.3M.- An example of a borrow transaction when BPRO is involved

Congratulations! You have successfully borrowed funds using the Sovryn platform.

- An example of a borrow transaction when BPRO is involved

¶ Adjust loan (Repay/Close/Adjust Collateral)

¶ 1. Access the dapp

- Go to https://sovryn.app to access the dapp.

¶ 2. Select Borrow → Fixed-interest loans

- From the top navigation menu, select the Borrow tab and then the Fixed-interest loans option.

¶ 3. Select the loan to adjust

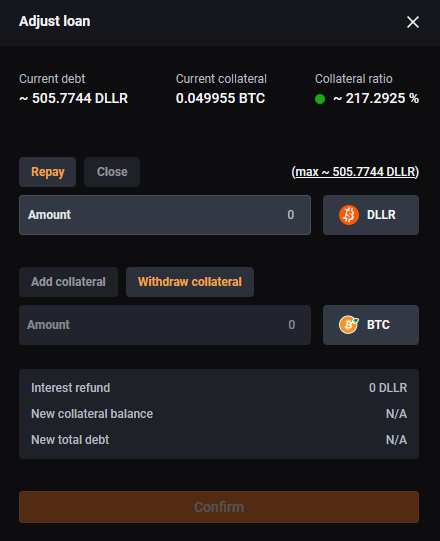

- Select the asset you would like to borrow and click Adjust. The graphic below uses the DLLR asset as an example.

¶ 4. Choose Repay, Close, or Add or Withdraw Collateral

- Repay will allow you to repay all or part of the loan. (Click on max amount to repay the full loan. If you specify the entire amount, the modal will switch to Close.)

- Close will repay the entire loan and will return the collateral to you.

- Add or Withdraw collateral will allow you to adjust the amount of collateral held by the loan as long as the collateral ratio doesn't drop below 150% after the adjustment.

¶ 5. Confirm your transaction

Once you've specified the adjustment you'd like to make, the Confirm button will activate. Check the settings you've specified and then click Confirm.

You will be prompted by your wallet to confirm the transaction.

- Confirm the adjustment process using your wallet.

Please be advised that the current transaction fees should be in the range of 0.065 GWEI.

Congratulations! You have successfully adjusted your loan in the Sovryn lending pool.

¶ Adjust loan (Repay) on the alpha dapp

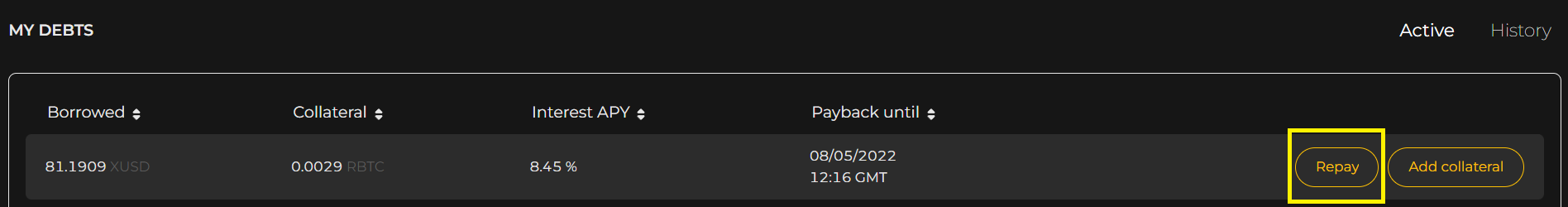

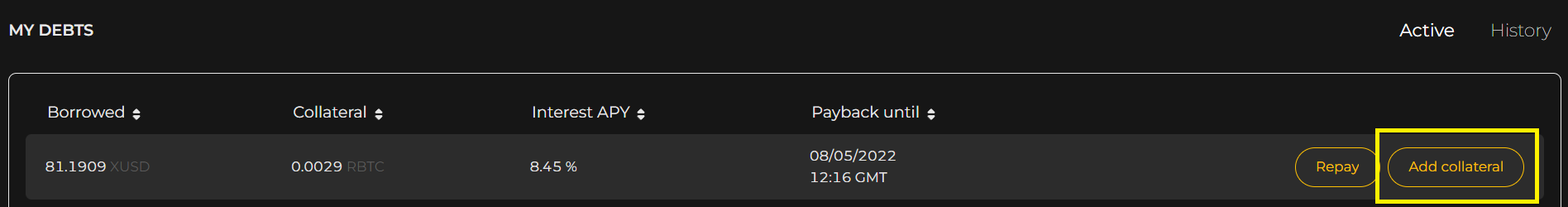

After a successful borrow transaction is complete, you now have a newly created debt. Near the bottom of the Finance -> Borrow page, you will see the section called MY DEBTS. This section lists a summary of all your debts:

- Amount borrowed

- Collateral used

- Current APY

- Payback date

The debt summary can be toggled between Active and Repaid debts.

To repay a debt:

¶ 1. Select the debt you wish to repay

- On the Active tab, select the debt you would like to repay from the debt summary.

¶ 2. Click on the “REPAY” button

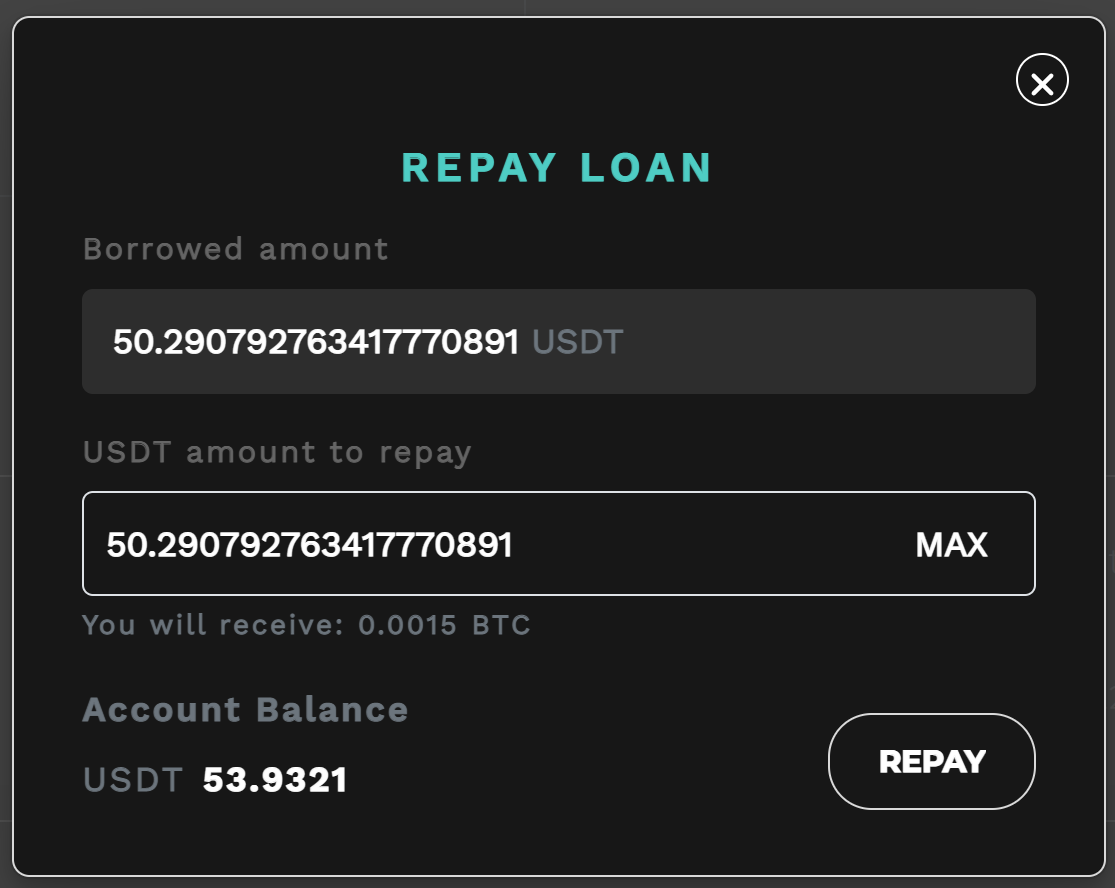

- The Repay Loan window will pop up.

¶

3. Enter the amount you wish to repay

- From the Repay Loan window, enter the amount you wish to repay.

¶

4. Approve & Confirm your transaction

After repaying from the previous step, you will be prompted by your wallet to perform approval and confirmation.

- Confirm the repayment transaction using your wallet.

Please be advised that the current transaction fees should be in the range of 0.065 GWEI, where the number of gas units used can vary in a range from 900K to 1.3M. Use the official RKS Gas Station tool to estimate the gas fee adjustment.- An example of a repayment transaction when BPRO is involved

Congratulations! You have successfully repaid borrowed funds on the Sovryn platform.

- An example of a repayment transaction when BPRO is involved

NOTE: You can find your loan history for closed-out loans by clicking the History tab in the MY DEBTS section.

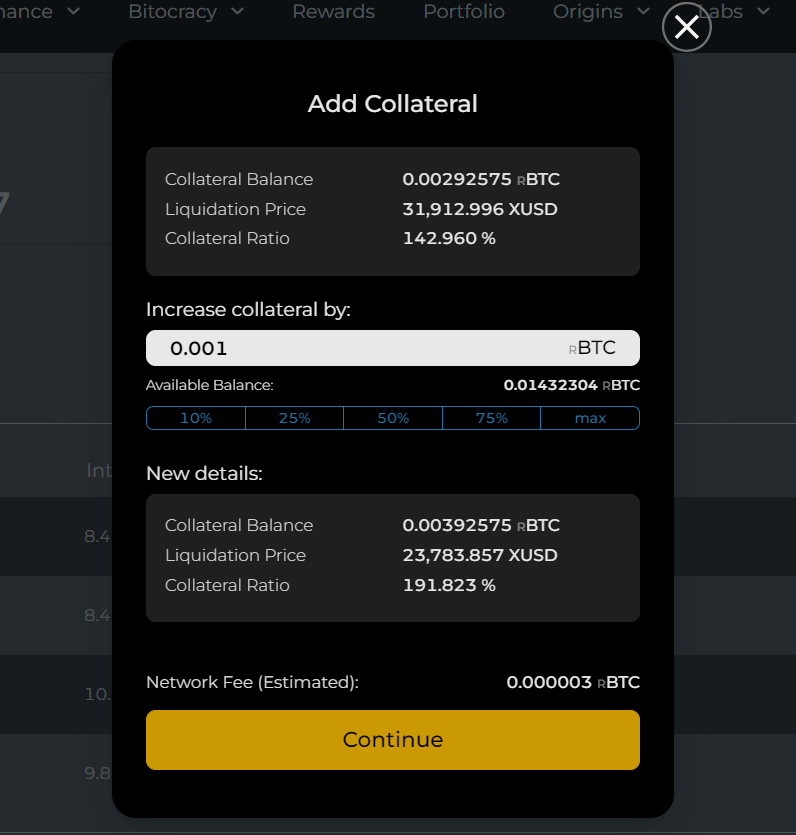

¶ Adjust loan (Add collateral) on the alpha dapp

Once you have a loan established, you have the option to add collateral. You may choose to add collateral if the collateral has dropped close to 115% to avoid liquidation.

To add collateral:

¶ 1. Go to MY DEBTS at the bottom of the Borrow page.

On the Active tab, find the loan you want to add collateral to, and click the Add Collateral button.

¶ 2. Specify the additional collateral

Fill in the form to specify the amount of collateral you want to add, and click Continue.

¶ 3. Approve & Confirm your transaction

After adding collateral from the previous step, you will be prompted by your wallet to perform approval and confirmation.

- Confirm the add collateral transaction using your wallet.

Please be advised that the current transaction fees should be in the range of 0.065 GWEI, where the number of gas units used can vary in a range from 900K to 1.3M. Use the official RKS Gas Station tool to estimate the gas fee adjustment.

Congratulations! You have successfully added collateral to your loan on the Sovryn platform.

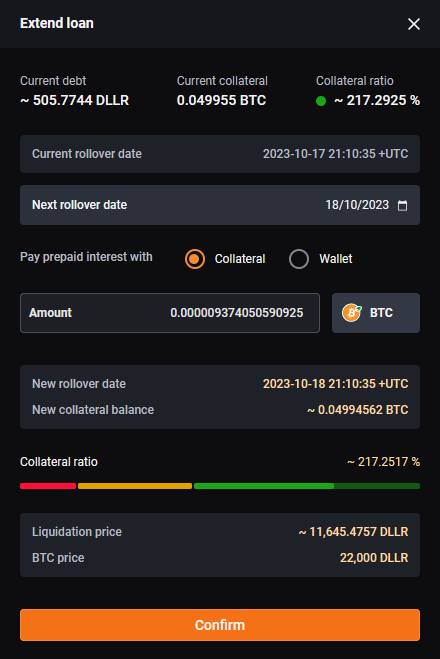

¶ Extend loan

¶ 1. Access the dapp

- Go to https://sovryn.app to access the dapp.

¶ 2. Select Borrow → Fixed-interest loans

- From the top navigation menu, select the Borrow tab and then the Fixed-interest loans option.

¶ 3. Select the loan to extend

- Select the asset you would like to borrow and click Extend. The graphic below uses the DLLR asset as an example.

¶ 4. Select date and source of interest

- Select the new rollover date for the loan.

- Select the source of the interest to be prepaid—either collateral or your wallet.

¶ 5. Confirm your transaction

Check the settings you've specified and then click Confirm.

You will be prompted by your wallet to confirm the transaction.

- Confirm the loan extension process using your wallet.

Please be advised that the current transaction fees should be in the range of 0.065 GWEI.

Congratulations! You have successfully extended your loan in the Sovryn lending pool.

¶ Disclaimer

- DISCLAIMER: Nothing on this page should be taken as investment advice. The inclusion of a third-party app or service does not constitute an endorsement of the app or service by Sovryn developers or anyone else in the Sovryn community and is provided for informational purposes only. If you have any problems with the listed third-party apps or services, please contact the maintainer of that app or service for help. Sovryn does not control your funds in any supported Web3 wallet - you are entirely responsible for your wallet security. Please do your own research and ensure you understand and accept the risks before trading or using any apps or services to store your funds.