¶ Zero protocol overview

Zero is a decentralized protocol that enables you to borrow DLLR—an aggregated USD-pegged stablecoin—or ZUSD—the Zero-native USD-pegged stablecoin—with zero interest using BTC as collateral. In normal mode, the loan must be maintained at a minimum collateral ratio (collateral/debt) of 110%. BTC must be transferred to the Rootstock (RSK) bitcoin sidechain in the form of RBTC to be used as collateral. Since RBTC is the native form of BTC on Rootstock, we refer to RBTC balances on Rootstock as BTC in this guide.

The Zero protocol is noncustodial, censorship-resistant, and governed by SOV stakers. The protocol is operated purely by smart contracts with no central controlling entity. As with the rest of the Sovryn ecosystem, users interact directly with the Zero protocol with no KYC.

You are strongly encouraged to learn about the details of the Zero protocol before you use it. In particular, you should read and thoroughly understand the risks before investing funds in Zero.

¶ Connect and fund your wallet

1. If you have not already set up a wallet, you must first set up your Web3-compatible browser wallet or hardware wallet for the Rootstock network.

2. Visit the dapp and then click the GET STARTED button.

3. You will be prompted to connect your wallet. Select either hardware or browser wallet and then the specific wallet within that category. For browser wallets, you can either select your connected browser wallet or use WalletConnect to pair with any WalletConnect-compatible browser or mobile wallet. Follow the prompts. Once you're connected you'll see the main Zero dapp page with a partial view of your wallet address in the upper right corner. This page also shows basic statistics about the current status of the Zero protocol and the related ecosystem at a glance.

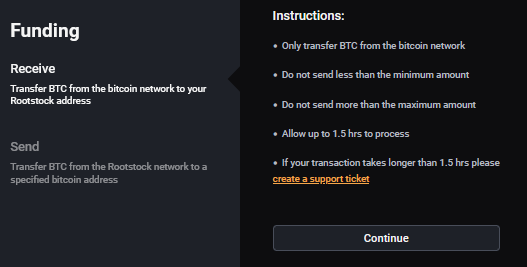

4. If you don't already have BTC for the collateral for your loan, you will need to fund your wallet. If you have BTC on the mainchain, you must transfer it to Rootstock. Click the Funding button in the upper right corner. The following pop-up will appear.

Make sure the Receive section is highlighted, and click Continue. A QR code will appear that represents a bitcoin address. You can use the QR code to send BTC to the encoded address or use the text code provided below the QR code to send BTC. Note that it may take up to 1.5 hours to receive. You can check that it has been received by looking at your wallet balance or by going to your portfolio on the Sovryn Alpha dapp.

¶ Open a line of credit

1. Go to the dapp. If you're not already on the Borrow tab, click it. Click on the Open line of credit button in the dapp. If you already have a line of credit, the available buttons will say Adjust and Close. In this case you can jump to Manage a line of credit.

2. You will be presented with a pop-up window that outlines all the ways you can put your loan to work. These are listed in the section Put your loan to work below for convenient reference along with live links.

Check the “Don't show again” box if you don't want to see this pop-up again. Click Finish.

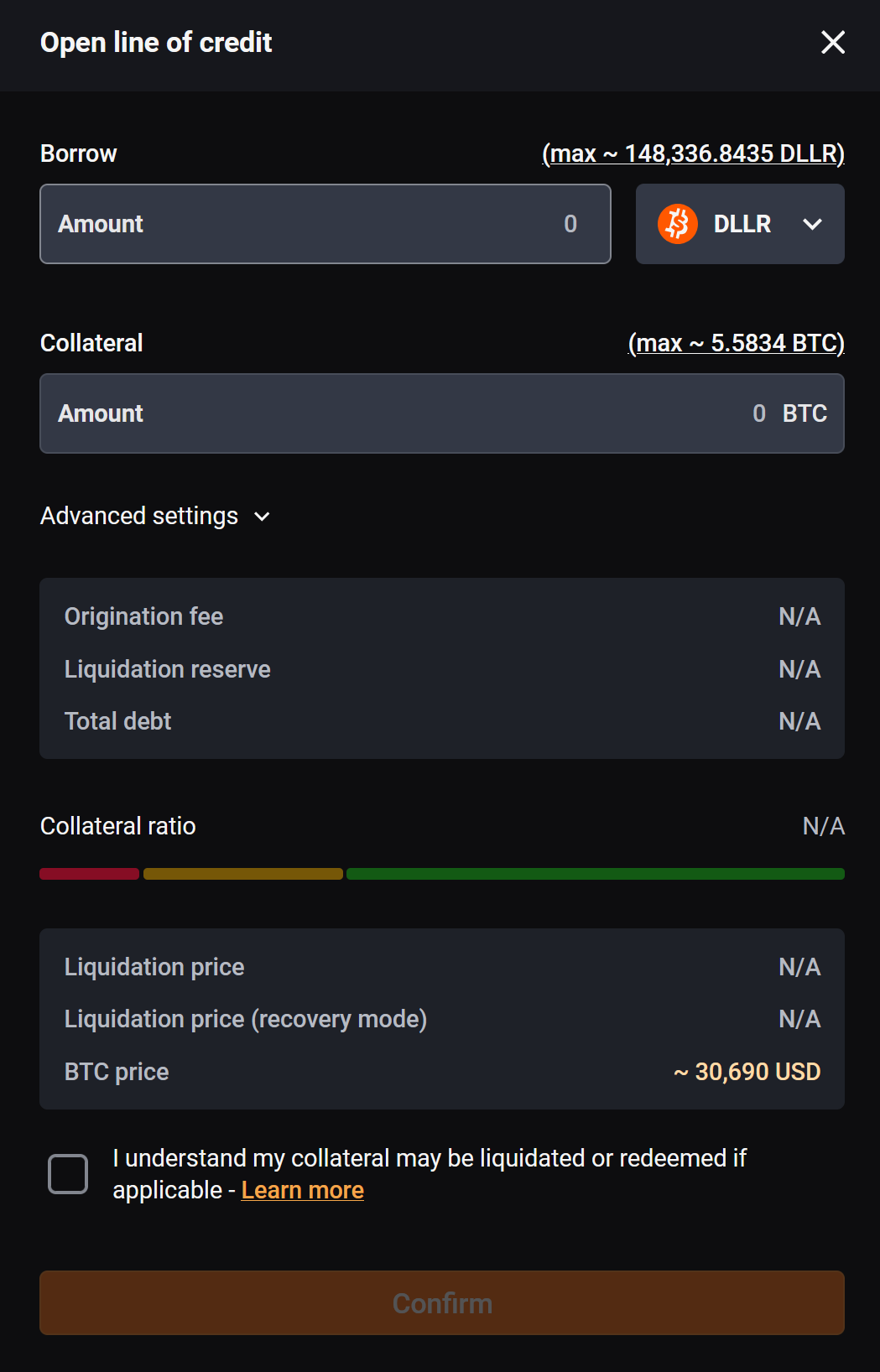

2. You will see the interface to open a line of credit:

Select between DLLR and ZUSD to specify your choice of currency for your loan.

3. Enter the amount you want to borrow in DLLR or ZUSD and the amount of collateral you want to provide in BTC. The interface will automatically calculate the collateral ratio based on the current BTC price. The collateral ratio must be at least 110%, or the transaction cannot be completed. Be sure to check that the calculated collateral ratio fits your risk parameters.

Below the amount fields you will see the origination fee, which is the current one-time fee you will be charged to initiate the loan. This fee varies with protocol activity but in normal mode has a minimum of 2.5%. (In Recovery Mode, the origination fee is set to zero.) The liquidation reserve is added to the debt to enable a liquidator to pay the gas for liquidation on your LoC if it falls below a 110% collateral ratio. This fee is refunded when you pay your debt and close the LoC. The total debt is the sum of the requested borrow amount, the liquidation reserve, and the origination fee.

Note the liquidation price shown at the bottom. You will need to monitor your LoC to make sure your collateral ratio does not fall too low, as indicated by the liquidation price. You must maintain the collateral ratio so that it never dips below 110%, which would trigger a liquidation. Furthermore, your collateral ratio should be well above the minimum individual collateral ratio in the system to avoid redemption. You may want to consult and monitor the “ZUSD redemption buffer vs. collateral ratio” in the Zero dashboard to assess how much ZUSD or DLLR would need to be redeemed before your chosen collateral ratio is touched by redemption. Consider setting up email notifications to keep you informed about your line of credit. In recovery mode the minimum required collateral ratio is 150%, so the liquidation price is higher. Recovery Mode occurs when the total collateral ratio of the system falls below 150%.

4. Confirm the transaction in the dapp and in your wallet.

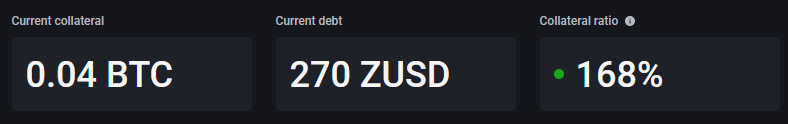

5. Once the transaction is complete, you will see a summary of your LoC on the dapp:

The pane shows both your Collateral and your Debt as well as the Collateral Ratio based on the current price of BTC.

¶ Put your loan to work

Once you have your loan, you can put it to work in a number of ways. Here are some ways to do that:

Stability pool

- Earn BTC by depositing into the Zero Stability Pool or Sovryn DLLR/RBTC Pool.

- Learn more - Stability Pool

- Learn more - AMM Pool

Trade

- Buy more BTC or other assets using the Sovryn exchange protocol.

- Learn more

¶ Manage a line of credit

Once you have an open LoC, you have two options for managing it: closing your line of credit (fully paying off the loan) or adjusting the balances of either or both of your debt and collateral.

¶ Close (pay off)

1. Go to the dapp. If you're not already on the Borrow tab, click it. Click on the Close button in the dapp. If you don't already have a line of credit, the available button will say Open line of credit . In this case you can jump to Open a line of credit.

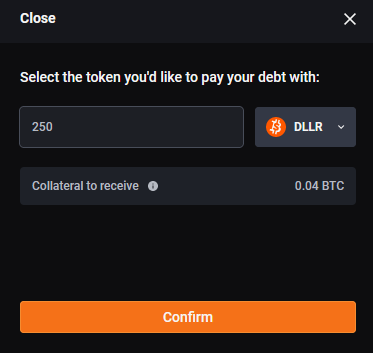

2. You will see the interface to close a line of credit:

The amount required to pay off the debt will be shown. Select the asset you want to use to pay off the debt.

3. Confirm the transaction in the dapp and in your wallet. The indicated amount of DLLR or ZUSD will be transferred from your portfolio to the protocol, and your wallet will receive the BTC collateral. The LoC will be closed.

¶ Adjust

1. Go to the dapp. If you're not already on the Borrow tab, click it. Click on the Adjust button in the dapp. If you don't already have a line of credit, the available button will say Open line of credit . In this case you can jump to Open a line of credit.

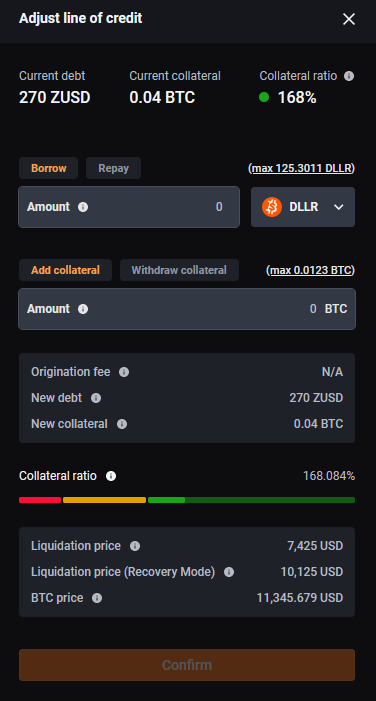

2. You will see the interface to adjust a line of credit:

3. You have several options, individually or in combination. First, you can either Borrow or Repay. Click the tab corresponding to your choice. (You can also leave it as is with an amount of 0.) Enter the desired amount you want to borrow or repay, and select your asset of choice.

4. Along with borrowing or repaying, you can choose to Add collateral or Withdraw collateral. Click the tab corresponding to your choice. (You can also leave it as is with an amount of 0.) Enter the desired amount you want to add or withdraw, and select your asset of choice.

5. No extra fee is charged unless you borrow more. Once you have noted the new collateral ratio and liquidation prices, Confirm the transaction in the dapp and in your wallet.

6. Once the transaction is complete, you will see a summary of your LoC on the dapp:

The pane shows both your Collateral and your Debt as well as the Collateral Ratio based on the current price of BTC.

¶ Earn in the stability pool

You can deposit DLLR or ZUSD to the stability pool to participate in liquidation gains and liquid SOV rewards. See Stability Pool for more details.

¶ Deposit

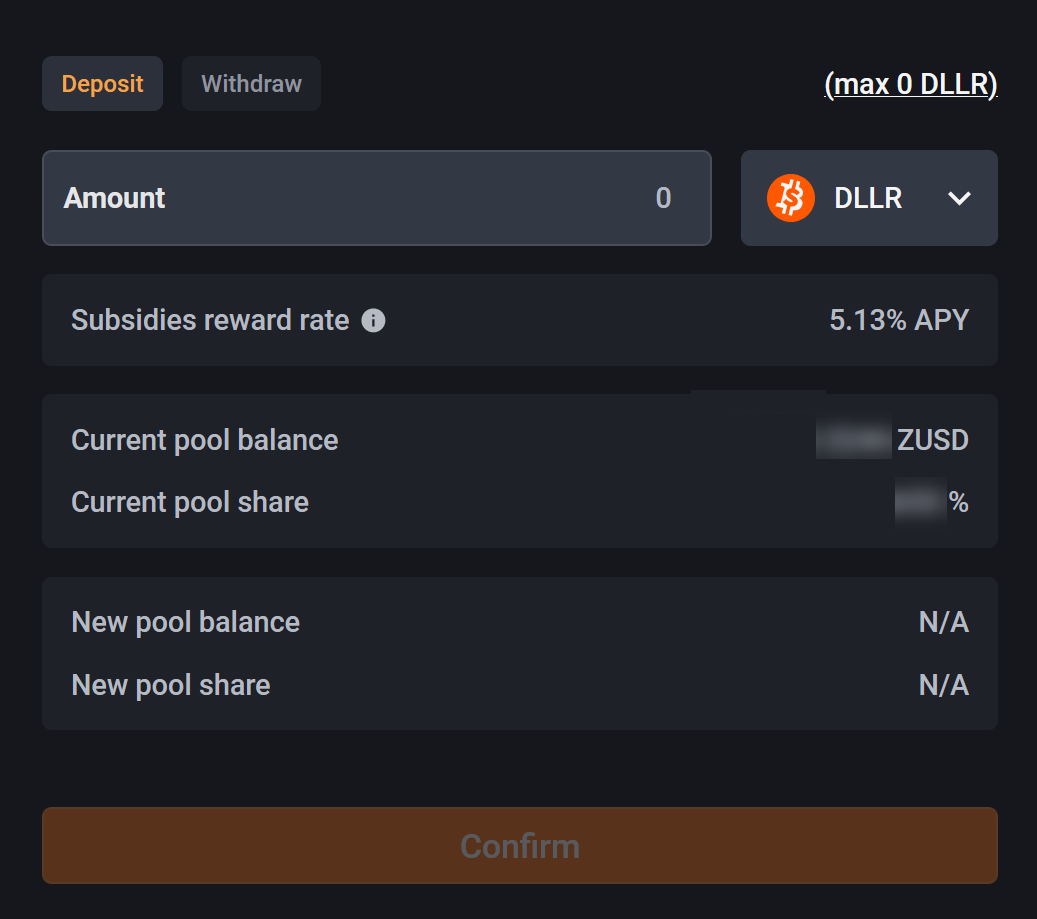

1. If you want to deposit funds to the stability pool, go to the dapp and select the Earn tab.

2. You will see the following pane. (If you have already deposited some funds, you will see options to deposit or withdraw.)

Enter the desired amount of DLLR or ZUSD. The pane will update to show your total pool balance and your share of the pool.

3. Confirm in the dapp and with your wallet. The indicated amount of tokens will be transferred from your wallet to the stability pool.

¶ Withdraw

1. If you want to withdraw funds from the stability pool, go to the dapp and select the Earn tab.

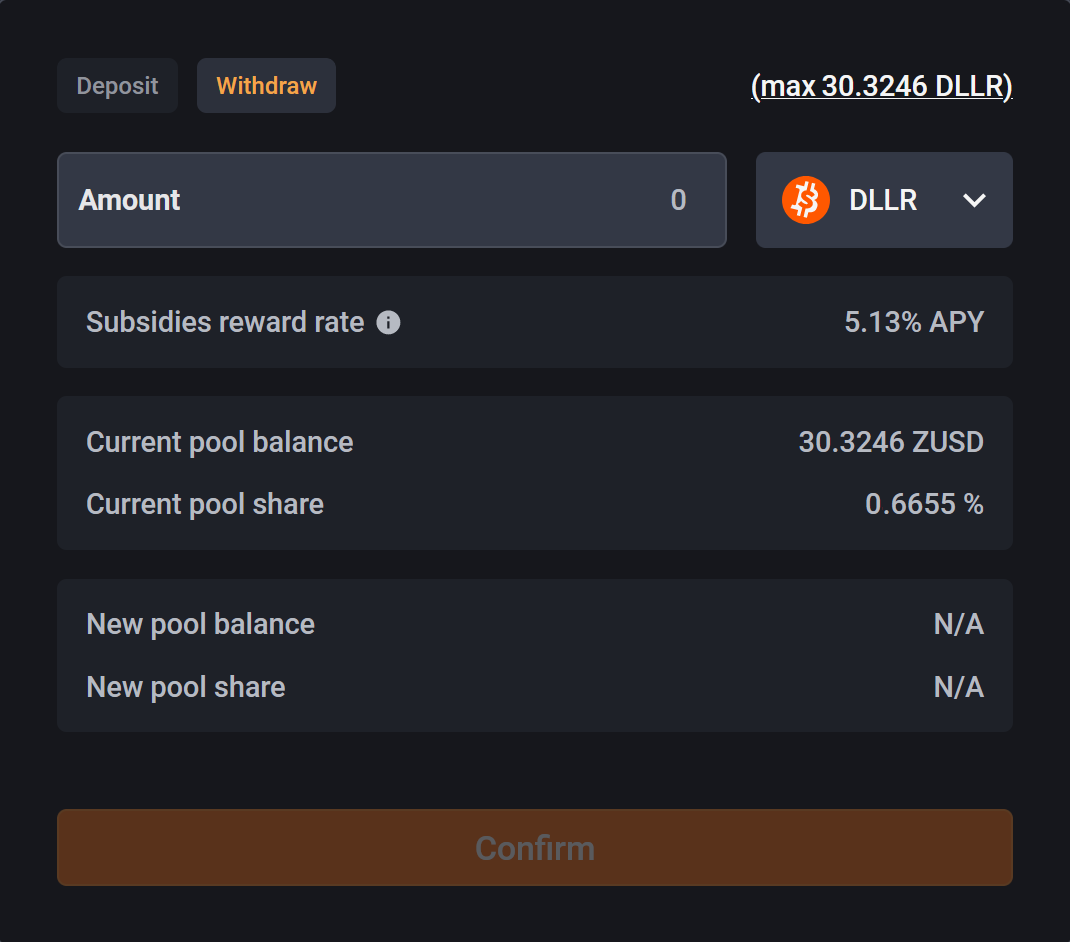

2. You will see the following pane, assuming you have already deposited some funds. Click the Withdraw tab.

3. Fill in the Amount of stablecoins you want to withdraw, and select the asset you want to withdraw. The pane will update with the new pool balance and share after the withdrawal is complete.

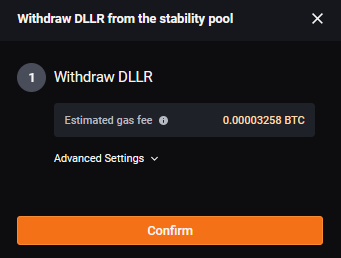

4. Confirm the amount of your withdrawal from the stability pool, and then confirm the transaction in the dapp and with your wallet.

¶ Claim BTC Rewards

As liquidations occur, your stability pool stablecoin deposit will be used to pay off debts in the liquidated LoCs and claim the BTC collateral. Therefore, over time you will accumulate BTC in the stability pool that you can claim. To claim rewards:

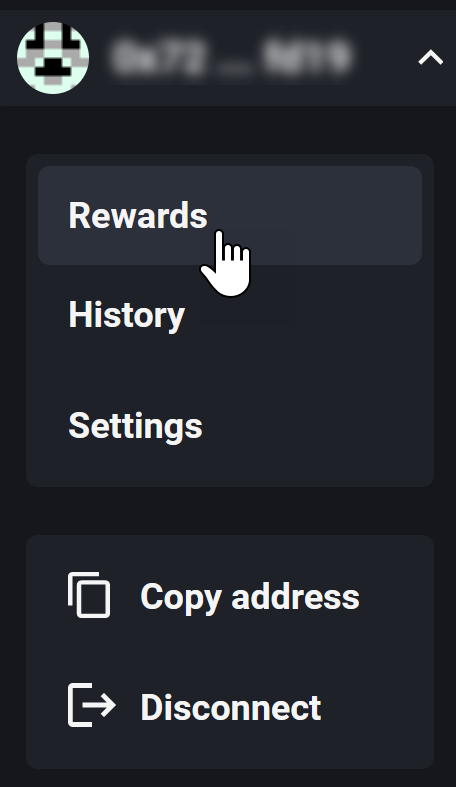

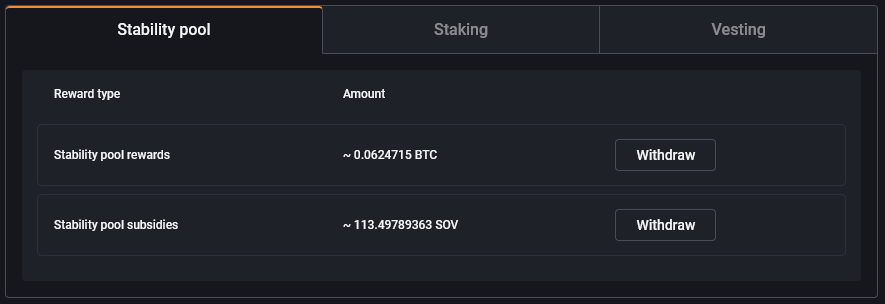

1. Go to the dapp and then to the account menu. Select Rewards.

2. Select the Stability pool tab. Click Withdraw to claim your stability pool BTC rewards and transfer to your wallet. If you have earned subsidies in the stability pool, use the same process to claim those as well. If you currently have a line of credit, you will also be given the option to Transfer to LOC. Clicking this option will add the BTC to your LOC collateral in Zero.

3. Confirm the transaction in the dapp. Confirm with your wallet. Your claimed BTC will be transferred from the stability pool to your wallet.

¶ Convert between supported assets

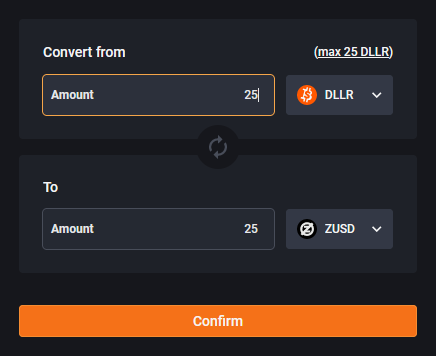

The Convert page supports converting one asset to another using a feature we call “smart routing”. The smart routing feature will take the given asset pair and search across multiple asset sources for the best price. Once it finds a route, the conversion details will be shown to the user. When the user clicks “Confirm” and signs and broadcasts the transaction, the conversion will be executed using the given route.

The asset sources currently supported include Mynt and the Sovryn AMM. Check the Convert page to see the latest assets supported.

1. If you want to convert between supported assets, go to the dapp and select the Convert tab.

2. You will see the following pane:

3. Fill in the amount you want to convert, and select the original asset and the target asset.

4. Confirm the transaction in the dapp. Confirm with your wallet. The indicated amount of assets will be converted from the “From” asset to the “To” asset.

¶ View history

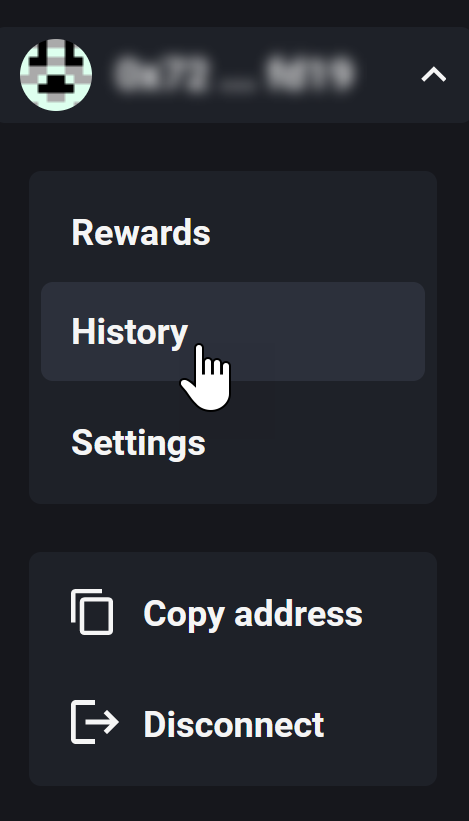

1. Access your transaction history by going to the dapp. Go to the account menu and select History.

2. This page gives you a My transaction history table, showing all your transactions in Zero in different categories. Click the relevant tab to see the history under each category. You can also click a button on each history table to export your transaction history in CSV format.

¶ Set notifications

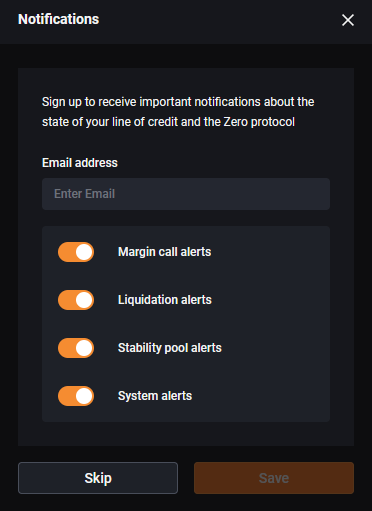

It is important to monitor your positions in Zero so you can adjust them in light of price movements and activity in the system. The dapp provides you with the opportunity to receive notifications for margin levels, liquidations, stability pool activity, and system alerts.

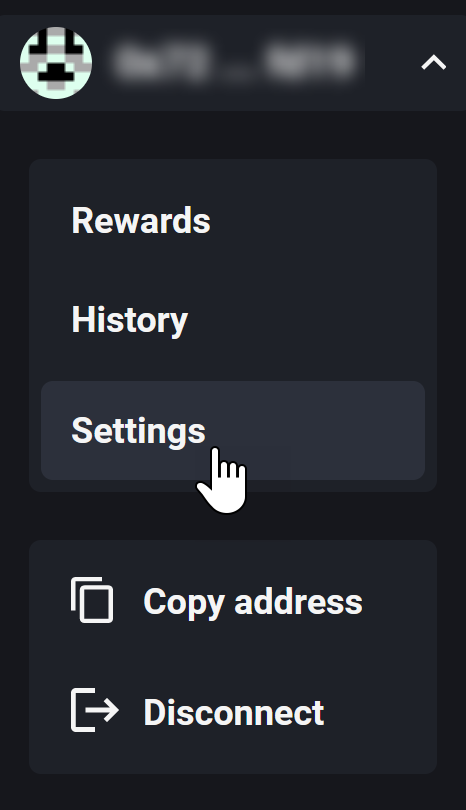

1. Access notification settings by going to the dapp. Go to the account menu and select Settings.

2. A pane as shown below will appear. Enter your email address, and select all the notification types you would like to receive (or unselect the notification types you do not want to receive). Then click Save.

Details of these notification are as follows:

- Margin call alerts

- your collateral ratio drops below 160%

- your collateral ratio drops below 150%

- your collateral ratio drops below 120%

- your collateral ratio is <10% higher than the total (system) collateral ratio during recovery mode

- Liquidation alerts

- your collateral ratio drops below 110% and is liquidated

- 110% ≤ your collateral ratio < total collateral ratio and line of credit is liquidated during recovery mode

- Stability pool alerts

- liquidation gains received

- System alerts

- total collateral ratio drops to 155%

- total collateral ratio drops to <150% and recovery mode activated

¶ Monitor the system

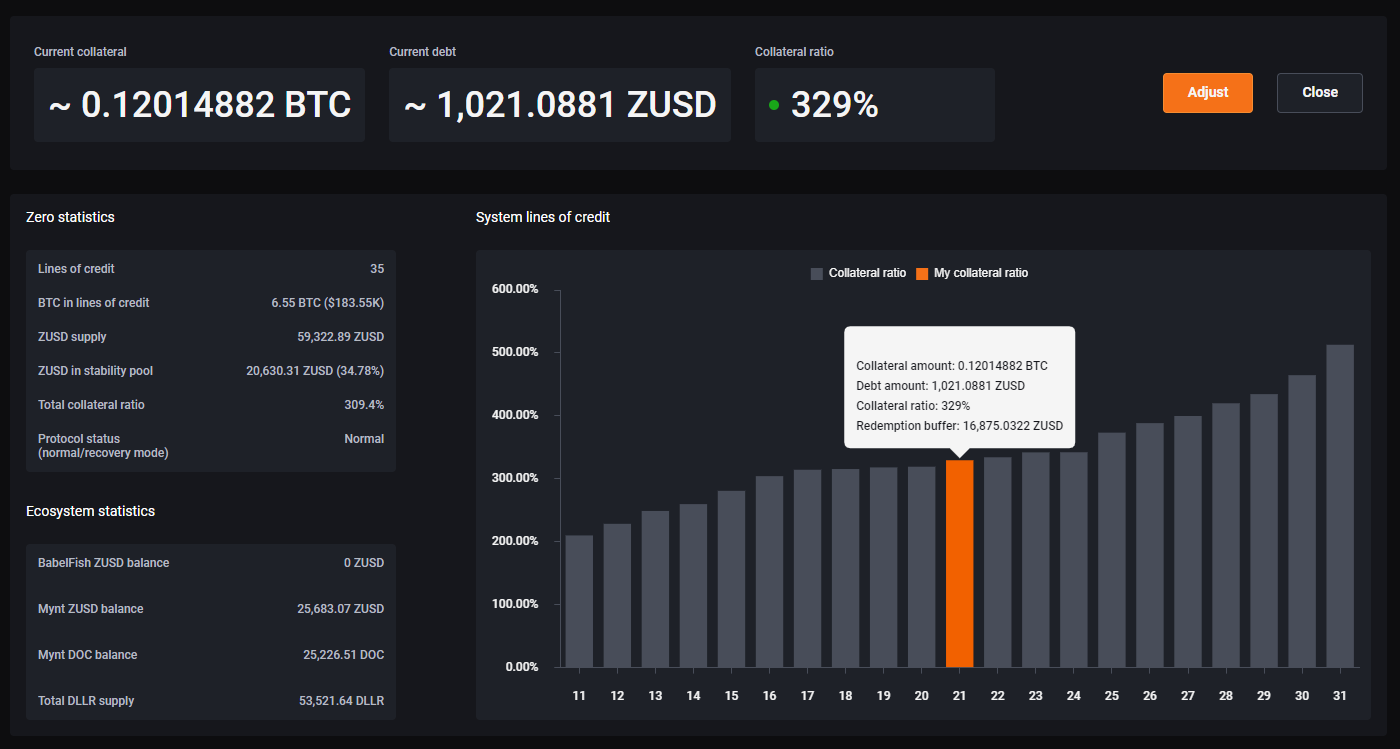

The information presented on the dapp changes depending on whether or not you have a line of credit. If you have a line of credit, it will be laid out like this (exact numbers will be different):

At the top you will see your own collateral, debt, and collateral ratio.

You will see a plot of the lines of credit that surround your line of credit (denoted by an orange bar on the chart). The x axis on the bottom indicates where your line of credit ranks in order from the lowest to highest collateral ratio lines of credit. If you hover over your line of credit's orange bar, you will see some statistics about your line of credit, including your collateral balance, debt amount, collateral ratio, and redemption buffer.

The redemption buffer is a statistic that tells you the minimum amount of ZUSD that would currently need to be redeemed before your collateral is next to be redeemed (more on redemptions in the next section). This statistic is calculated by determining the minimum amount of ZUSD that would be need to be incrementally redeemed to move each line of credit that is currently below your line of credit in the collateral ratio ranking to instead be above your line of credit in the collateral ratio ranking. Keep in mind that, like your collateral ratio and ranking in the overall list of lines of credit, this redemption buffer value is a snapshot in time and will change as the overall state of the system changes.

Elsewhere on this page, you will see statistics of the Zero system as a whole, including total BTC collateral, total ZUSD issued, and total collateral ratio.

You will see ecosystem statistics, indicating how much of each stablecoin is aggregated to make up the supply of DLLR in Mynt and how much ZUSD is in the Babelfish stablecoin aggregator.

You can also access the Zero dashboard, which gives detailed information about system status, historical information, and current lines of credit.

¶ Liquidations and redemptions

As a decentralized mechanism for liquidations, the protocol incentivizes third parties to monitor LoCs and liquidate those that become undercollateralized. Anyone can liquidate an LoC as soon as it drops below the minimum collateral ratio. However, this is expert functionality and can only be handled by direct smart-contract interaction. It is expected that third-party bots will execute liquidations very rapidly before manual contract calls can occur. Therefore, this operation is not included in the dapp or covered in this guide.

To maintain the peg floor of ZUSD, the protocol allows any holder of ZUSD to redeem it for the same nominal value in BTC. However, this is expert functionality intended to defend the peg and not intended for convenient swapping of ZUSD for BTC. Users who want to simply swap ZUSD or DLLR for BTC can use the Convert feature to do this. If the smart-routing determines that redemption gives the best price, the swap will be handled via the redemption mechanism. Thus, the redemption operation can only be directly accessed by direct smart-contract interaction. It is expected that third-party bots will execute redemptions very rapidly before manual contract calls can occur whenever a price imbalance relative to BTC or another stablecoin is detected. For these reasons, this operation is not included in the dapp or covered in this guide.

If your LoC is liquidated in recovery mode and its collateral ratio is between 110% and 150% at the time of liquidation, then you will have surplus collateral to claim. This is the collateral that is left over after collateral equal to 110% of the value of your debt is liquidated. For example, if you have 0.5 BTC of collateral in your LoC , and 110% of the value of your debt is equal to 0.4 BTC at the time that your LoC is liquidated, then your surplus collateral available to claim will be 0.1 BTC.

Similarly, if your line of credit is fully redeemed, you will also have surplus collateral to claim. This is collateral that is left over after collateral equal to 100% of the value of your debt is redeemed. For example, if you have 0.5 BTC of collateral in your LoC, and 100% of the value of your debt is equal to 0.35 BTC at the time that your LoC is liquidated, then your surplus collateral available to claim will be 0.15 BTC.