¶ Overview of Zero

Zero is a decentralized protocol that enables you to borrow ZUSD—a USD-pegged stablecoin—with zero interest using BTC as collateral. The loan must be maintained at a minimum collateral ratio (collateral/debt) of 110%. BTC must be transferred to the Rootstock bitcoin sidechain in the form of RBTC to be used as collateral.

The Zero protocol is non-custodial, censorship-resistant, and governed by stakers. The protocol is operated purely by smart contracts with no central controlling entity. As with the rest of the Sovryn ecosystem, users interact directly with the Zero protocol with no KYC. Therefore, it is censorship-resistant and under the control of Bitocracy.

¶ Benefits of Zero

Stablecoins have become a key component of decentralized finance, currently valued at over a hundred billion dollars and enabling cross-chain transactions as well as access to fiat currency equivalents. Zero offers a capital efficient, user-friendly, and decentralized way to borrow stablecoins. ZUSD is the USD-pegged stablecoin used to issue loans on the Zero protocol. It can be redeemed at any time for the underlying RBTC collateral at face value.

Zero requires less collateral than other systems. Instead of liquidating your RBTC to access its value, you can deposit your RBTC in the protocol while continuing to own it, borrow against the collateral to withdraw ZUSD, and then repay your loan whenever you like. Once you have ZUSD, you can swap it for dollars and pay off a loan or make a purchase. You can even use it to buy more bitcoin.

Key benefits of Zero include:

- no interest — Unlike most loans, Zero loans do not accumulate more and more debt.

- low collateral ratio requirement — Zero uses RBTC on deposit efficiently, requiring only a 110% collateral ratio.

- stablecoins backed by bitcoin — ZUSD is overcollateralized by bitcoin and does not rely on algorithmic tricks or an economically correlated altcoin to establish its value.

- redeemable for dollar value — ZUSD can be redeemed at the USD face value by any holder for RBTC held as collateral, guaranteeing a price floor of 1 USD.

- extension of the Sovryn protocol — All operations are executed by automated smart-contract algorithms that are open and auditable, and protocol parameters are upgradable by Bitocracy. The protocol is censorship-resistant.

Users can invest with Zero in several ways:

- Borrow ZUSD secured by RBTC by opening a Line of Credit (LoC).

- Secure Zero by depositing ZUSD into the Stability Pool to participate in liquidation gains.

- Stake SOV to earn from ZUSD origination and redemption fees.

- Redeem 1 ZUSD for 1 USD worth of RBTC when the ZUSD peg falls below 1 USD.

¶ Fees

Zero only charges one-time fees. An origination fee is charged when ZUSD is borrowed, and a redemption fee is charged when ZUSD is redeemed:

- The origination fee is a percentage of the loan amount (in ZUSD).

- The redemption fee is a percentage of the amount redeemed (in RBTC) when exchanging ZUSD for RBTC. Note that redemption is not the same as repaying your loan, which is free.

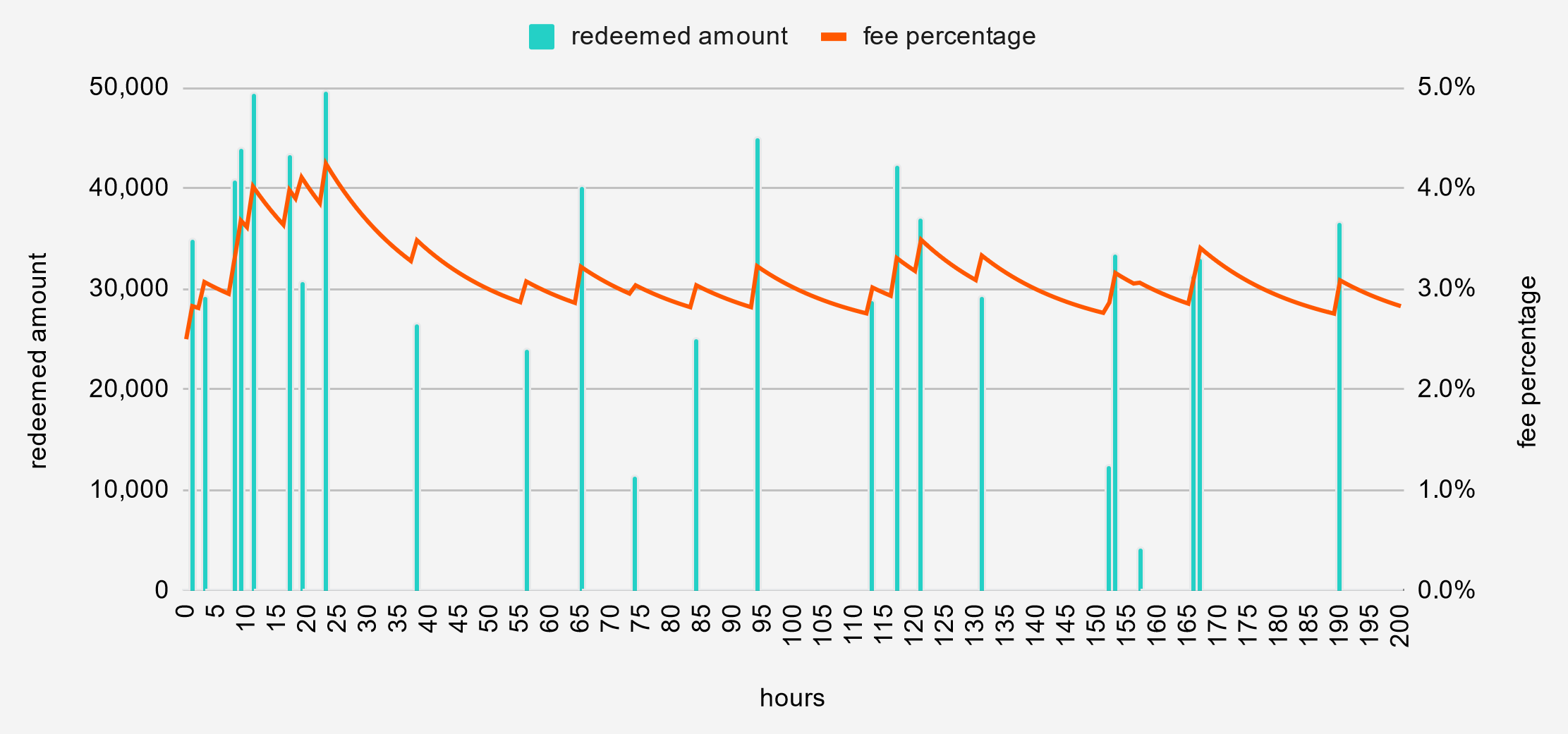

Both fees vary as a function of redemption volumes. They increase with each redemption in proportion to the redeemed amount, and they decay over time as long as no redemptions take place. Higher fees discourage both large redemptions and borrowing immediately after large redemption volumes. The fee gradually decays so borrowers and redeemers will pay less when redemption volumes are low.

The fees will not fall below 5%, except in Recovery Mode. The fee floor prevents arbitrageurs from misusing the redemption function by front-running the price feed. The origination fee can go no higher than 5% so that loans do not become too unattractive for borrowers even when the monetary supply contracts due to redemptions. With the exception of the origination fee cap, the origination and redemption fees are identical. A typical fee variation over time is shown below.

¶ Risks

Because the system is non-custodial, all user funds deposited to the protocol are held and managed by the smart-contract system without involving a person or legal entity. That means your funds are handled according to the rules coded into the smart contract. These smart contracts are available for review in the Sovryn Github. The code has been audited twice by Trail of Bits, once by Coinspect, and once by Chainsulting (see audits).

You could lose some of your funds in the following situations:

- You are a borrower, and your RBTC collateral is liquidated upon your collateral ratio falling below 110% (or below the total collateral ratio in recovery mode). You keep your borrowed ZUSD, but your LoC will be closed and your collateral forfeited (in recovery mode, only collateral worth 110% of the value of your outstanding debt will be liquidated, the rest will be available to reclaim). The LoC debt will be paid off either from the Stability Pool or by redistributing the debt to other lines of credit.

- You are a borrower, the Stability Pool is empty when an LoC falls below 100% collateralization due to a precipitous drop in the price of RBTC, and the LoC gets liquidated. Because of the empty Stability Pool, the debt and the RBTC collateral in that LoC would be redistributed to other borrowers on a pro-rata basis. In this case, the debt would be higher than the RBTC collateral, causing borrowers to experience a net loss. This is an extremely unlikely scenario because it would require the Stability Pool to be empty and more than a 10% drop in market price before liquidation triggered by the 110% collateral ratio requirement could occur.

- You are a borrower whose LoC is near the lowest collateral ratio in the system. Anyone who holds ZUSD can choose to redeem their ZUSD for RBTC, which is drawn from the lowest-collateralized loan(s). If someone redeems a sufficient amount of ZUSD, your RBTC collateral will be swapped for their ZUSD. In that case, the amount of ZUSD redeemed is paid off from your loan, but the same face value of your RBTC collateral is forfeited to the redeemer. The net value of your LoC remains the same, but you now have less RBTC and less debt. If your LoC is near the lowest collateral ratio, you run the risk that it will become the lowest after lower LoCs are liquidated or redeemed. This is described in more detail in Redemption against your LoC.

- You are a Stability Pool depositor and your deposited ZUSD is used to repay debt from liquidated borrowers. Since a liquidation occurs when the LoC collateral drops below 110%, the RBTC you receive in the liquidation is very likely to be worth more than the ZUSD funds paid in the liquidation. However, if you continue to hold RBTC, you are taking on the market risk of RBTC. If it decreases in price, you may lose value in your total pool deposits.

- You are a Stability Pool depositor, there is a precipitous drop in the price of RBTC, and a LoC is liquidated below 100% collateralization. In this case, the debt would be worth more than the RBTC collateral, causing Stability Pool depositors to experience a net loss. This is an extremely unlikely scenario because it would require a more than a 10% drop in market price before the liquidation is confirmed.

Although the system is carefully audited, the possibility of a hack or a bug that results in losses for users can never be fully eliminated (see disclaimer).

¶ Borrowing

To borrow ZUSD, all you need is an RSK-compatible wallet and sufficient RBTC collateral to act as security for your debt. Zero only supports RBTC as collateral. With your connected wallet, you can open an LoC. In addition to an origination fee, you will pay a small gas fee in RBTC to fuel the transaction on RSK. A minimum debt of 200 ZUSD is required.

Loans issued by Zero have no repayment schedule. You can repay your debt whenever you choose as long as you maintain a collateral ratio of at least 110%. The collateral ratio is defined as the ratio between the USD value of the collateral in your LoC and the LoC debt in ZUSD. Zero is able to offer such a low minimum collateral ratio because it makes liquidation instantaneous and more efficient, providing the same security level as similar protocols that rely on lengthy auction mechanisms to sell off collateral in liquidations.

¶ The magic of interest-free borrowing

The Zero system requires no interest because it enables you to borrow from yourself. ZUSD tokens are essentially certificates you issue to yourself that represent a claim on a specific value of RBTC denominated in USD.The borrowed ZUSD has no opportunity cost because it is minted rather than diverted from another use. The loan has no carrying costs; it is simply recorded in the blockchain, awaiting the execution of a smart contract to unlock the assets. The risk of the loan is borne entirely by the borrower—since the borrower's assets are locked.

The protocol is supported by one-time origination fees and redemption fees that are set algorithmically based on recent redemption volume in the protocol.

¶ Line of Credit (LoC)

An LoC is a ledger where you take out and maintain your loan. LoCs are similar to Vaults, CDPs, or Troves found on other platforms. LoCs maintain two balances: one is an asset (RBTC) acting as collateral; the other is a liability (ZUSD) that defines the debt. You can change the amount of either balance by adding or withdrawing collateral and borrowing or repaying debt. As you change these balances, your LoC collateral ratio changes as well. You can close your LoC at any time by repaying your debt in full.

¶ Origination fees

Whenever you withdraw ZUSD from your LoC, a one-time origination fee is applied to the amount withdrawn and added to your debt. This fee is set algorithmically, with a minimum value of 5% ordinarily. The fee is 0% during Recovery Mode. A 20 ZUSD Liquidation Reserve charge is applied as well but is returned when you repay your debt.

The origination fee is specified by a baseRate, which is the algorithmically determined rate at or above the 5% floor. Thus, baseRate + 5% is the fee rate. The fee rate is restricted to a range between 5% and 7.5% and is multiplied by the amount of liquidity withdrawn by the borrower to determine the origination fee.

Example: The origination baseRate stands at 0% and the borrower requests 4000 ZUSD from his open LoC. After deducting the 20 ZUSD Liquidation Reserve, the amount of liquidity being withdrawn is 3980-fee, and the fee rate is applied to 3980-fee. Therefore, the fee is calculated by satisfying the relationship (baseRate + 0.05)*(3980 - fee) = fee, or fee = (baserate+0.05)/(1+baseRate+0.05)*3980, which results in a fee of 189.52 ZUSD. After the fee of 189.52 ZUSD is deducted, the borrower obtains a net of 3810.48 ZUSD. Since 20 ZUSD is set aside as a Liquidation Reserve charge, the amount available to withdraw is 3810.48-20.00=3790.48 ZUSD.

Under ordinary operations the fee rate is expected to remain at or near 5%.

¶ Collateral ratios

Your LoC collateral ratio is the ratio between the USD value of the collateral in your LoC and the LoC debt in ZUSD. The collateral ratio of your LoC will fluctuate as the price of RBTC changes. You can change the ratio by adjusting your RBTC collateral or changing the level of your debt.

Example: Suppose the current price of RBTC is $40,000 and you decide to deposit 3 RBTC. If you borrow 30,000 ZUSD, then the collateral ratio for your LoC would be 3*40,000/30,000 = 400%.

If you instead took out 80,000 ZUSD, your ratio would be 150%.

The minimum collateral ratio (MCR) is the lowest ratio of collateral to debt allowed before a liquidation is triggered under normal operations (Normal Mode). This is a protocol parameter, currently set to 110%. If your LoC has a debt of 10,000 ZUSD, for example, you must maintain at least $11,000 worth of RBTC as collateral in your LoC to avoid being liquidated.

In Recovery Mode, the MCR is raised to 150%. Therefore, you should keep the ratio well above 150% to avoid liquidation in case the protocol enters Recovery Mode. A collateral ratio of 200% or higher is recommended.

¶ Liquidation of your LoC

Your LoC is subject to liquidation if your collateral ratio falls below the MCR. If that happens, you will lose your collateral but will no longer have a debt in ZUSD. If your debt is liquidated, you will no longer be able to retrieve your collateral by repaying your debt. Because your collateral is worth 110% of your debt at liquidation, this results in a net loss of 9.09% (= 100% * 10 / 110) of the dollar value of your collateral.

If the protocol is in Recovery Mode your LoC is subject to liquidation if your collateral ratio is below 150%. In that case, liquidation loss is capped at 110% of LoC debt. Any remaining collateral above 110% of debt can be reclaimed by the liquidated borrower using the standard web interface. This means that a borrower will face the same liquidation penalty (10%) in Recovery Mode as in Normal Mode if an LoC is liquidated.

When you open an LoC and obtain a loan, 20 ZUSD is set aside as a Liquidation Reserve to compensate gas costs for the transaction sender if your LoC is liquidated. The Liquidation Reserve is fully refundable if your LoC is not liquidated and is refunded to you when you close your LoC by repaying your debt. The Liquidation Reserve counts as debt and factors into the calculation of your LoC collateral ratio, slightly increasing the actual collateral requirements.

If an LoC is liquidated and the Stability Pool is empty (or gets emptied in the process of the liquidation), you may discover that the collateral and debt of your LoC has increased without your intervention. If a liquidation occurs and the Stability Pool is empty, every borrower will receive a portion of the liquidated collateral and debt as part of a redistribution process. This will generally result in a gain because the liquidation of the collateral is triggered at 110% of the debt.

¶ Redemption against your LoC

If the ZUSD market price falls enough below the value of USD, an arbitrage opportunity is created to redeem ZUSD for RBTC and then sell the RBTC for a higher USD price. In essence, redeemers buy RBTC at a discount. This action will tend to close the gap between the ZUSD price and USD and is an intentional part of the peg mechanism. When ZUSD is redeemed, the RBTC sold to the redeemer is allocated from the LoC(s) with the lowest collateral ratio (even if it is above 110%). If you have the LoC with the lowest ratio at the time of redemption, you will lose some of your collateral, but your debt in ZUSD will be reduced by the same face-value amount.

The USD value of the RBTC collateral you give up corresponds to the nominal ZUSD amount repaid on your LoC’s debt. You can interpret a redemption as another party repaying your debt and being reimbursed an equivalent amount of your collateral. The net value of your LoC does not change, but your debt in ZUSD and your collateral in RBTC are reduced by the same value. As a positive side effect, a redemption increases the collateral ratio of the affected LoC, making it less exposed to liquidations or further redemptions. Borrowers can avoid losing assets to a redemption by maintaining a high collateral ratio relative to the other LoCs in the system. The riskiest LoCs are the lowest-collateralized LoCs; these are first in line when a redemption takes place.

Redemptions that do not fully repay the debt of an LoC are called partial redemptions; redemptions that fully pay off the debt are called full redemptions. In a full redemption, your LoC is closed, and you can claim your remaining collateral at any time.

Example: You own an LoC with 2 RBTC collateral and a debt of 65,000 ZUSD. The current price of RBTC is $40,000. This puts your collateral ratio (CR) at 123% (= 100% * (2 * 40,000) / 65,000). Suppose this is the lowest CR in the Zero system and consider partial and full redemptions:

Partial redemption

Someone redeems 15,000 ZUSD for 0.375 RBTC and thus repays 15,000 ZUSD of your debt, reducing it from 65,000 ZUSD to 50,000 ZUSD. In return, 0.375 RBTC, worth $15,000, is transferred from your LoC to the redeemer. Your collateral decreases from 2 to 1.675 RBTC, while your collateral ratio goes up from 123% to 134% (= 100% * (1.675 * 40,000) / 50,000).

Full redemption

Someone redeems 120,000 ZUSD for 3 RBTC. Given that the redeemed amount is larger than your debt minus 20 ZUSD (your Liquidation Reserve), your debt of 65,000 ZUSD is entirely cleared and your collateral gets reduced by $64,980 of RBTC, leaving you with a collateral of 0.38 RBTC (= 2 - 64,980 / 40,000 ) that you can claim. Your Liquidation Reserve is burned to pay off the final $20 of debt not redeemed for RBTC collateral.

¶ Stability Pool

The Stability Pool is the first line of defense in maintaining system solvency. It achieves that by acting as the source of liquidity to repay debt from liquidated LoCs—ensuring that the total ZUSD supply always remains fully collateralized.

When any LoC is liquidated, the ZUSD debt in the LoC is paid from the Stability Pool. The debt is canceled, and the corresponding ZUSD from the Stability Pool is burned. In exchange, the Stability Pool receives the entire collateral from the LoC. In addition, stability pool depositors receive rewards in SOV.

¶ Stability Pool deposits

The Stability Pool is funded by users transferring ZUSD into it (called Stability Providers). As liquidations occur, Stability Providers pay off loans in ZUSD from the Stability Pool and gain RBTC collateral in the process. Over time they lose a pro-rata share of their ZUSD deposits, while gaining a pro-rata share of the liquidated RBTC collateral.

Because LoCs are likely to be liquidated at just below 110% collateral ratios, Stability Providers can expect to receive a greater USD value of RBTC collateral than the ZUSD debt they pay off. This provides an incentive for investors to provide ZUSD to the Stability Pool. To become a Stability Pool depositor, you need to have ZUSD. You can borrow ZUSD by opening an LoC, or you can buy ZUSD on the open market.

¶ Liquidation process

Zero uses a liquidation process to maintain full collateral backing of the entire stablecoin supply. LoCs that fall under the minimum collateral ratio (MCR) of 110% will be closed (liquidated). The debt of the LoC is paid off by burning ZUSD from the Stability Pool, and in exchange the LoC RBTC collateral is distributed among Stability Providers.

The owner of the LoC keeps all the borrowed ZUSD but loses all the RBTC collateral, amounting to a loss of ~10% value overall. Thus, a borrower should always keep the ratio above 110%. Above 150% is recommended to maintain a safe margin.

To maintain decentralization of the system, the protocol incentivizes third parties to monitor LoCs and liquidate those that become undercollateralized. Anyone can liquidate an LoC as soon as it drops below the MCR, a process that can be done either manually or with a bot. The initiator receives a gas compensation (20 ZUSD + 0.5% of the LoC collateral) as a reward for this service.

The liquidation of LoCs requires gas costs that the initiator must cover. The protocol offers a gas compensation given by the following formula:

gas compensation = 20 ZUSD + 0.5% of LoC collateral (RBTC)

The 20 ZUSD is the Liquidation Reserve set aside in the borrowing process. The variable 0.5% part (in RBTC) is taken from the liquidated collateral, slightly reducing the liquidation gain for Stability Providers.

¶ Stability pool rewards

In addition to possible liquidation gains, stability pool depositors receive rewards in liquid SOV as a steady source of revenue. Currently, stability pool depositors receive rewards at a rate of 5% APR. These SOV rewards can be staked to share in protocol revenue or held for possible appreciation. Because the rewards are liquid, they can also be claimed and sold at any time.

¶ Redemptions and ZUSD peg

¶ ZUSD price stability mechanisms

The ability to redeem ZUSD for RBTC at face value (1 ZUSD can be exchanged for 1 USD of RBTC) creates a price floor of 1 USD, and the ability to borrow ZUSD at the minimum collateral ratio of 110% creates a price ceiling through arbitrage. If the price rises about 1.10 USD, an arbitrageur can borrow ZUSD with 110% RBTC collateral that gets liquidated but then purchase more than the lost RBTC with the ZUSD that is worth more than 110% of the USD value of the collateral. We call these "hard peg mechanisms" because they are based on direct processes.

ZUSD also benefits from less direct mechanisms for maintaining the peg to USD. These are called "soft peg mechanisms". One soft-peg mechanism is a 1:1 peg as a Schelling point. Since Zero treats ZUSD as being equal to USD, parity between the two is an implied equilibrium state of the protocol. Another of these mechanisms is the variable origination fee on new debts. As redemptions increase (implying ZUSD is below 1 USD), the baseRate increases as well. Borrowing becomes less attractive, and the rate of borrowing slows. Less ZUSD comes onto the market, and the reduced supply drives the price back up toward 1 USD.

In the Sovryn ecosystem, ZUSD can be converted directly to and from XUSD with a 1:1 value, which allows XUSD to share in maintaining the peg to USD.

¶ Redemption process

A redemption is the process of exchanging ZUSD for RBTC at face value, treating 1 ZUSD as worth exactly 1 USD. In a redemption of X ZUSD you get X USD worth of RBTC in return. Users can redeem their ZUSD for RBTC at any time with no limitations.

Redemption is a completely different process from paying back a debt. Anyone who holds ZUSD can redeem it for RBTC. A borrower, on the other hand, deposits ZUSD into the corresponding LoC to pay back a debt is deposit. The process of repaying a debt is always free, whereas redemptions are usually charged a fee.

¶ Redemption fee calculation

Under normal operation, the redemption fee (in RBTC) is given by the formula (baseRate + 1%) * RBTCdrawn

Redemption fees are based on the baseRate state variable in Zero, which is dynamically updated. The baseRate increases with each redemption and decays according to time passed since the last fee event — either the last redemption or loan of ZUSD.

Upon each redemption:

- baseRate decays based on time passed since the last fee event

- baseRate increments by an amount proportional to the fraction of the total ZUSD supply that was redeemed

- The redemption fee, which is deducted from the RBTC received by the redeemer, is given by (baseRate + 1%) * RBTCdrawn

Example: Suppose the current redemption fee is 1%, and the price of RBTC is $50,000. If you redeem 10,000 ZUSD, you will receive 0.198 RBTC (0.2 RBTC minus a redemption fee of 0.002 RBTC).

Note that the redeemed amount itself is taken into account for calculating the baseRate and might have a noticeable impact on the redemption fee applied in the current transaction, especially if the amount is large.

¶ Price oracles

Zero uses two different price oracles to determine the USD price of BTC for the purposes of liquidations and redemptions: a primary oracle (Money On Chain) and a secondary oracle (RSK Oracle) that will be used if the primary oracle does not report prices for longer than four hours. If both oracles go offline for more than four hours, the last reported price is used until both oracles come back online and report prices within 5% of each other. SOV Bitocracy can be used to replace either or both oracles if they are determined to be indefinitely unreliable.

¶ SOV staking for Zero fees

Users who would like to profit from fees collected by the Zero protocol may do so by staking SOV, the governance token of the Sovryn protocol. To start staking you simply purchase SOV and then deposit it to the Sovryn staking contract. Stakers earn a pro rata share of the origination fees in ZUSD and redemption fees in RBTC according to their Voting Power as well as other fees in the Sovryn protocol. Your SOV stake will earn a share of the fees equal to your share of the total Voting Power at the instant the fee occurred.

While it is not possible to stake ZUSD, you can deposit ZUSD into the Stability Pool to earn yield via liquidation gains.

In some similar protocols such as MakerDAO with the DAI stablecoin, staked tokens are used to backstop the system. Zero does not use the SOV governance token in this way. All ZUSD issued by Zero is overcollateralized by RBTC borrower deposits that are locked in the smart-contract system.

¶ Recovery mode

Recovery Mode is a special operating mode of the system that is designed to improve the system collateral ratio if it gets too low. Recovery Mode is triggered when the Total Collateral Ratio (TCR) of the system falls below 150%. The TCR is the ratio of the Dollar value of the entire system collateral at the current RBTC:USD price to the entire system debt. That is, the TCR is the collateral of all LoCs expressed in USD, divided by the debt of all LoCs expressed in ZUSD.

¶ Recovery mode policies

During Recovery Mode, LoCs with a collateral ratio below 150% can be liquidated.

As a further recovery step, the system blocks borrower transactions that would further decrease the TCR. New LoCs can only be opened with a collateral ratio ≥ 150%. New ZUSD is only issued to existing LoCs if users simultaneously deposit RBTC and withdraw ZUSD in a collateral ratio that is higher than the current TCR.

While Recovery Mode has no impact on the redemption fee, the origination fee is set to 0% to maximally encourage borrowing within the collateral requirement enforced during Recovery Mode.

Recovery Mode incentivizes borrowers to promptly raise the TCR back above 150%. It also incentivizes ZUSD holders to replenish the Stability Pool due to the higher likelihood of liquidation gains. Recovery Mode is designed to encourage collateral top-ups and debt repayments. The potential threat of Recovery Mode also acts as a self-negating deterrent: the undesirable consequences of Recovery Mode actually guide the system away from reaching it. Recovery Mode is an undesirable state for the system.

¶ Liquidations in Recovery Mode

You can be liquidated in Recovery Mode if your LoC collateral ratio is below 150%. To avoid liquidation in Normal Mode and Recovery Mode, you should keep your LoC collateral ratio above 150%. You can raise your collateral ratio by adding collateral, repaying debt, or both.

Individual LoC liquidations in Recovery Mode (TCR < 150%) are executed as follows:

- ICR = Individual Collateral Ratio

- TCR = Total Collateral Ratio

- SP = Stability Pool

| Condition | Liquidation Behavior |

|---|---|

| ICR ≤ 100% | All debt and collateral in the LoC (minus RBTC gas compensation) is redistributed to active LoCs. (This condition should rarely if ever occur.) |

| 100% < ICR ≤ 110% | ZUSD in the Stability Pool pays off the LoC debt. The LoC RBTC collateral (minus RBTC gas compensation) is shared among depositors in the Stability Pool. If the Stability Pool is empty (or becomes emptied), remaining debt and collateral in the LoC are redistributed to active LoCs. |

| 110% < ICR < TCR | If the Stability Pool has sufficient funds, ZUSD in the Stability Pool pays off the LoC debt. The LoC RBTC collateral (minus RBTC gas compensation) is then shared among depositors in the Stability Pool up to 110% of the debt. Remaining collateral can be reclaimed by the borrower. The LoC is closed. |

| ICR > TCR | Do nothing. |

In Recovery Mode, liquidation loss of collateral is capped at 110% of LoC debt. Any remaining collateral above 110% of debt can be reclaimed by the liquidated borrower using the standard web interface. This means that a borrower is subject to the same liquidation penalty (10%) in Recovery Mode as in Normal Mode if an LoC is liquidated.