Sovryn is a decentralized finance platform that requires no permissions and will never take custody of your keys or assets. To enable trustless trades and swaps, Sovryn uses Automated Market Makers (AMMs) so that a market for trading is always available without depending on individual buy and sell orders being available on the opposite side of each trade.

¶ What is an AMM?

An Automated Market Maker (AMM) is a decentralized protocol that prices assets based on a mathematical formula. This differs from a conventional order book, which simply stores and matches buy and sell orders. For an order-book system to fulfill an order of "buy asset X at price Y," a matching order must exist to "sell asset X at price Y". Instead, AMMs use liquidity pools that contain a balance of both assets.

Most of the AMMs employed by Sovryn use balanced liquidity pools, with 50% of the value held in each asset. Deposits to the pool must be made in both assets with equal values of each. As buying and selling take place, the relative amount of each asset changes in the pool, and the price is adjusted so that the total value of each asset remains balanced at 50% of the total. Sovryn uses the Bancor (v1) pricing formula that maintains a constant product of the amount of each asset. If this formula price deviates too far from the market price, arbitrageurs step in with buying or selling pressure to realign the price. If the relative price between the two assets moves significantly, liquidity providers can experience divergence loss (divergence loss), which means a relative loss in value when compared to holding the two assets at an initial 50/50 split without rebalancing them.

Other pools employed by Sovryn allow for variable ratios of the two assets in the pool. These are referred to as Sovryn Dynamic Automated Market Makers (DAMMs). The Dynamic aspect of the AMM mitigates divergence loss through dynamic pool asset ratio balancing. It also enables liquidity providers to provide liquidity in one asset or any ratio of the two assets rather than a 50/50 balance of both.

AMM pools on BOB allow two forms of liquidity—standard 50/50 liquidity provided across the full range of price (described above as balanced liquidity pools) and concentrated liquidity where liquidity is provided only within a price range specified by the user. The latter is more capital efficient but is only active when the price is within the given range. Otherwise, that liquidity is not available as part of the pool and does not earn fees. Concentrated liquidity is also subject to higher divergence loss than full-range liquidity. Concentrated liquidity is primarily for advanced users who want to actively manage their liquidity positions.

¶ Providing liquidity

Market making is traditionally provided by a centralized market to provide liquidity for trades or swaps. AMMs remove the need for a centralized service by using liquidity providers. Liquidity providers (LPs) lock their assets in a pool that functions as a market maker in return for LP tokens—a representation and receipt of their share within the pool. Fees are generated in the denomination of the target asset. For example, a trade of USDT to BTC generates a fee in BTC. This fee is distributed to liquidity providers as payment for their market-making service. See What are the fees? for details on the fees collected by the system and paid to providers.

¶ Rewards

Rewards are sometimes offered by the protocol to attract more liquidity to a pool. On Sovryn, these rewards are paid in SOV, the governance token of the Sovryn protocol. Rewards for specific pools are listed at the top of the market-making dapp page. These rewards are subject to change as the needs of the protocol evolve. Rewards are specified in total weekly SOV rewarded to pool participants on a pro-rated basis. Pool APR shown in the table for each pool expresses the annualized return from transaction-fee sharing and rewards combined. SOV earned from rewards is not immediately liquid. Rewards must first be claimed from the liquidity pool from the Rewards page on the dapp to begin a vesting period. Once rewards are claimed, they are locked in a vesting contract of 40 weeks with a maximum 4-week cliff. As rewards are vested, they can be withdrawn by going to the Rewards page on the dapp, selecting the Vesting tab, and then clicking Withdraw. This process is explained in more detail in Sovryn Rewards & Staking Fees Explained. Ordinary fee rewards for liquidity provision can be claimed from the Liquidity mining tab and then clicking Withdraw.

Earning rewards for providing liquidity is sometimes called yield farming or liquidity mining. Yield farming describes the process from the perspective of the user who is seeking extra rewards for providing liquidity. Liquidity mining describes the process of attracting assets to a liquidity pool from the perspective of the protocol—mining liquidity from potential users and compensating them with transaction fees and rewards.

¶ Single-sided liquidity

While some AMMs require LPs to take on exposure to multiple assets, single-sided pools on Sovryn do not. In these pools any user can provide liquidity to a pool with a single token and maintain 100% exposure to that token. For example, in the RUSDT/BTC pool, an LP can provide BTC only or RUSDT only as liquidity to the pool. This allows them to maintain exposure on a single asset while earning fee rewards and any rewards being offered. This is known as a Sovryn DAMM (Bancor v2) pool.

Single-sided pool list (on Rootstock):

- RUSDT/BTC

- DOC/BTC

- BPRO/BTC

These pools are available on Sovryn dapp under Earn→Market making. All other pools are double-sided. Please read the section below for details.

¶ Double-sided liquidity

Pools like the SOV/BTC and ETH/BTC Liquidity Pools are double-sided (Bancor v1) liquidity pools. To provide liquidity to the SOV/BTC pool, for example, you must provide equal liquidity value to both assets of the pool, SOV and BTC. Other than this, the overall process of providing liquidity in the SOV/BTC pool is the same as single-sided liquidity pools. The amount of BTC required will be automatically calculated by the protocol. Be sure to have adequate BTC in your wallet for the amount of SOV you wish to supply to the pool AND to cover the transaction fees of providing and eventually withdrawing.

Double-sided pools on the dapp (Rootstock):

- DLLR/BTC

- SOV/BTC

- FISH/BTC

- MOC/BTC

- RIF/BTC

- MYNT/BTC

- BNBS/BTC

- ETHS/BTC

- XUSD/BTC

- POWA/BTC

¶ Staked balance vs contract balance (one-sided pools)

For one-sided pools, the system distinguishes between the contract balance and the staked balance. The contract (or current) balance indicates the number of tokens held by the contract at any time. The staked balance indicates the total amount of tokens staked by liquidity providers, which is a record of the pool's obligation to its LPs. The current balance can diverge from the staked balance due to the volatility of one of the assets in the pool. When the current balance differs from the staked balance, the pool's weights are adjusted to incentivize arbitrageurs to return the current balance back to its staked balance. Although the arbitrage incentive does not always push the balance back to 100% equilibrium, frequent arbitrage operations guarantee that it always remains very close to (slightly below or above) the staked balance.

¶ Divergence loss

In one-sided liquidity pools, the current balance can deviate from the staked balance between the time an LP deposits liquidity and the time it is withdrawn. If the current balance is lower than the staked balance at the time of withdrawal, the liquidity provider's share of the pool is worth less than the initial liquidity amount provided. This is called divergence loss or impermanent loss. It is sometimes called impermanent because providers can wait for the balances to be equalized and withdrawn without suffering a loss—if the balances come back to the original ratio.

In two-sided pools, divergence loss occurs as the asset values are automatically rebalanced in a 50/50 split as one asset moves in price relative to the other. This occurs because the rebalancing increases the amount of the under-performing asset to maintain the 50/50 value split. An increasing relative weight on the under-performing asset means that the overall value grows more slowly and falls more rapidly than simply holding the two assets in an initial 50/50 split but without rebalancing them. Divergence loss is magnified in a concentrated liquidity position.

Divergence loss is a present risk that every LP should be aware of when providing liquidity. Trading fees and rewards could outweigh or at least offset divergence loss.

¶ How to provide liquidity on Rootstock

¶ 1. Access the dapp

- Go to https://sovryn.app to access the dapp.

¶ 2. Get started

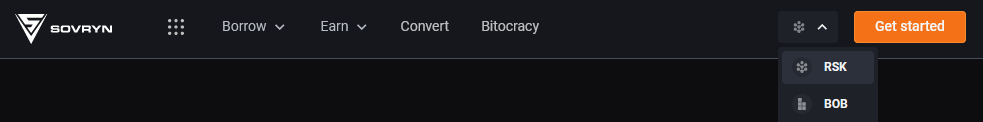

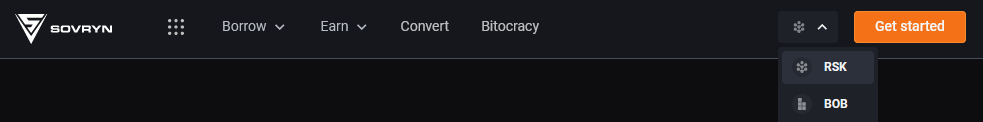

- On the top-right dropdown, select the RSK (Rootstock) chain. Then click the Get started button to connect your wallet, and follow the on-screen instructions. If you have not already set up your wallet to connect with the Sovryn dapp, visit the Wallet Setup Guide section before proceeding further.

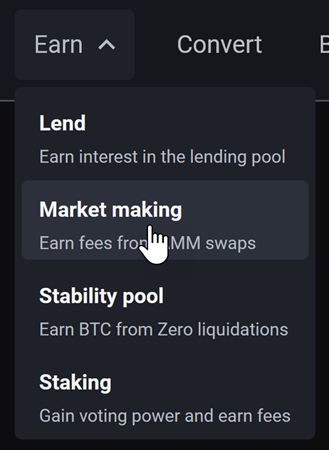

¶ 3. Select Earn → Market making

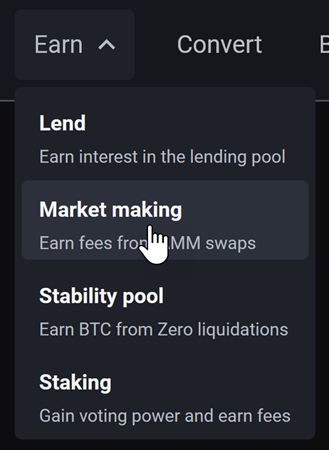

- From the top navigation menu, select the Earn tab and then the Market making option.

¶ 4. Deposit liquidity and confirm the associated transaction

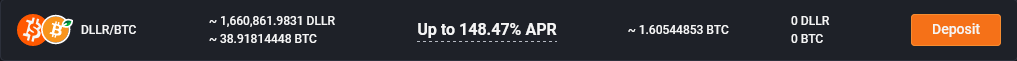

- On the Market making page, select the pool of your choice and click the Deposit button on the right. In the example made for this step, we chose the DLLR/BTC option.

- In the following pop-up window, enter the Deposit amount for DLLR, double check your entries, and click Deposit.

Remember that the deposit needs to be made in a 1:1 ratio with its paired asset. You will also need a small amount of BTC for the contract creation and confirmation. - Confirm the deposit using your wallet.

Please be advised that the current transaction fees should be in the range of 0.026 GWEI.

Congratulations! You have successfully deposited liquidity for market making.

¶ How to provide liquidity on the Alpha dapp

Note that you can also provide liquidity on the newer dapp.

https://www.youtube.com/embed/iIUqNvB1NJ4

¶ 1. Access the Sovryn Alpha dapp

- Go to https://alpha.sovryn.app to access the Sovryn Alpha dapp.

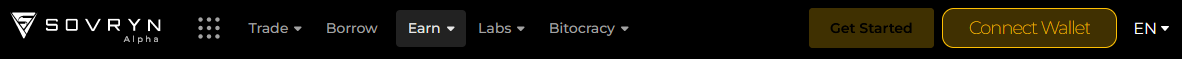

¶ 2. Connect your wallet

- On the right top, connect your wallet by clicking the Get Started or Connect Wallet button. If you have not already set up your wallet to connect with the Sovryn dapp, visit the Wallet Setup Guide section before proceeding further.

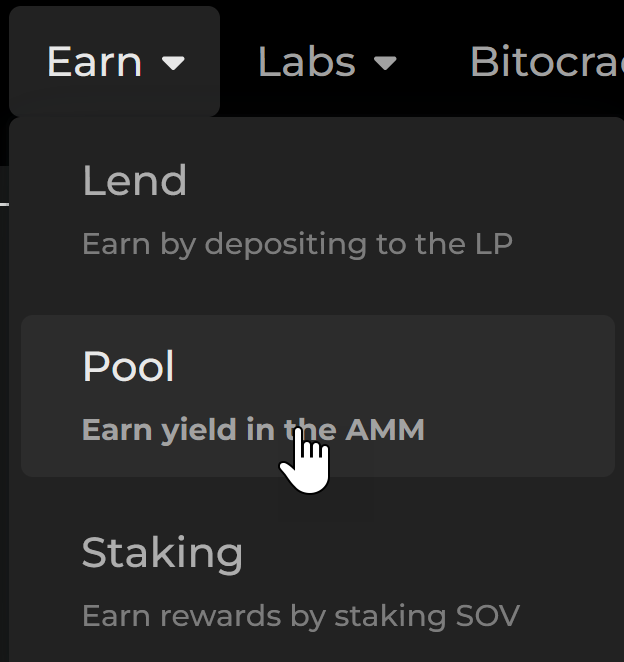

¶ 3. Select Earn → Pool

- From the top navigation menu, select the Earn tab and continue with the Pool option.

¶ 4. Deposit liquidity and confirm the associated transaction

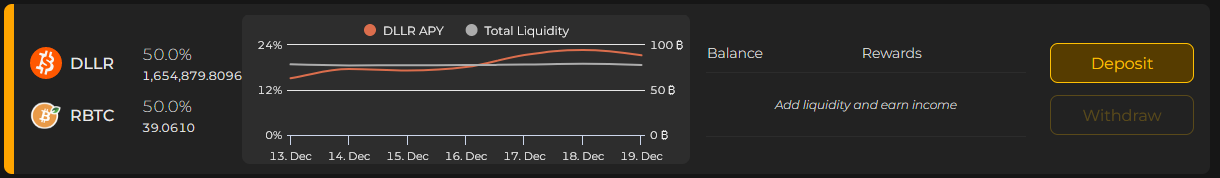

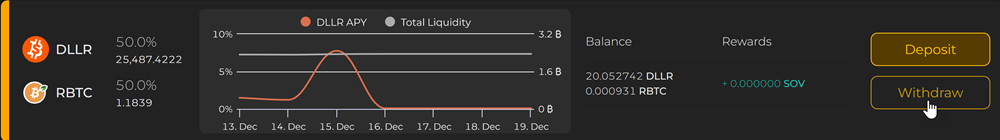

- On the Yield Farm page, select the pool of your choice and click the Deposit button on the right. In the example made for this step, we chose the DLLR/RBTC option. (Note that Rootstock BTC is referred to as RBTC on the Sovryn Alpha dapp but BTC on the new dapp. It is the same asset.)

- In the following pop-up window, enter the Deposit amount, double check your entries, and click the Deposit button.

Remember that the deposit needs to be made in a 1:1 ratio with its paired asset. You will also need a small amount of RBTC for the contract creation and confirmation. - Confirm the deposit using your wallet.

Please be advised that the current transaction fees should be in the range of 0.026 GWEI.

Congratulations! You have successfully deposited liquidity for market making.

¶ How to provide liquidity on BOB

Note that each chain has its own pairs of assets. Once you access the market-making page, you can see which pairs are available.

¶ 1. Access the dapp

- Go to https://sovryn.app to access the dapp.

¶ 2. Get started

- On the top-right dropdown, select the BOB chain. Then click the Get started button to connect your wallet, and follow the on-screen instructions. If you have not already set up your wallet to connect with the Sovryn dapp, visit the Wallet Setup Guide section before proceeding further.

¶ 3. Select Earn → Market making

- From the top navigation menu, select the Earn tab and then the Market making option.

¶ 4. Select desired pool

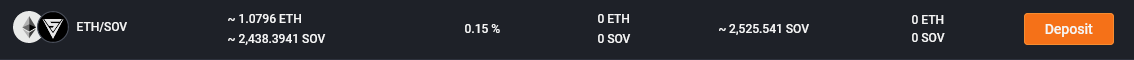

- On the Market making page, select the pool of your choice and click the Deposit button on the right. In the example made for this step, we chose the ETH/SOV option.

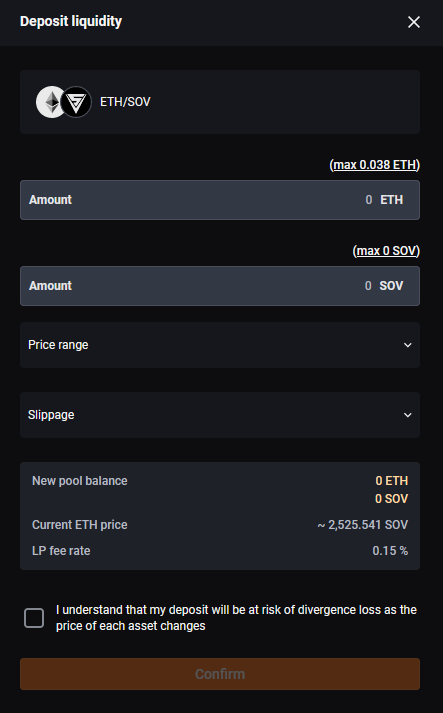

¶ 5a. Deposit full-range balanced liquidity

These instructions are for depositing liquidity that is available over the full range of prices.

- In the pop-up window, enter the Deposit amount for the first asset you want to deposit (ETH in this case), and the dapp will automatically fill in the required amount of the second (SOV in this case). Double check your entries, confirm that you understand the risk of divergence loss, and click Confirm.

The deposit needs to be made in a 1:1 ratio with its paired asset. You will also need a small amount of ETH for the deposit.

- Confirm the deposit using your wallet.

Congratulations! You have successfully deposited liquidity for market making.

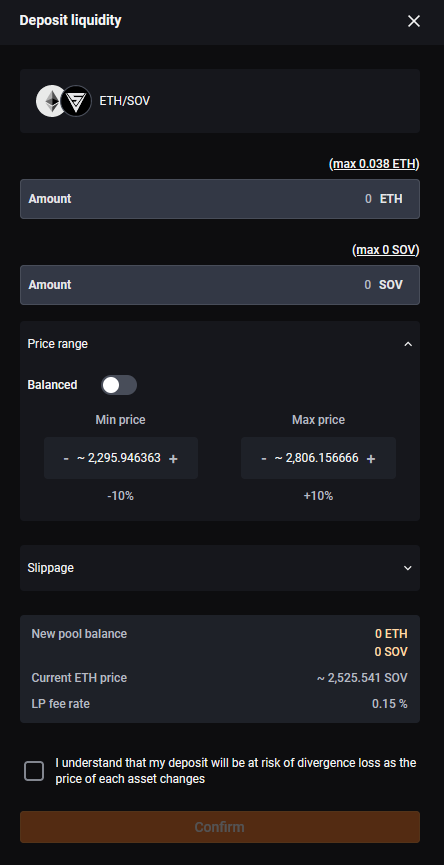

¶ 5b. Deposit concentrated liquidity

If you want to deposit liquidity that is available over a specified range of prices, you may specify the price range for the first asset.

- In the pop-up window, enter the Deposit amount for the first asset you want to deposit (ETH in this case), and the dapp will automatically fill in the required amount of the second (SOV in this case).

The deposit needs to be made in a 1:1 ratio with its paired asset. You will also need a small amount of ETH for the deposit. - Click the Price range dropdown to reveal min/max price fields. Select the min price and the max price. Or click the Balanced switch and simply specify the percentage range. If the current price is not within the specified range, the liquidity will not be made available for trading until the price moves within the range and you will not earn fees on your liquidity.

- Double check your entries, confirm that you understand the risk of divergence loss, and click Confirm.

- Confirm the deposit using your wallet.

Congratulations! You have successfully deposited liquidity for market making.

¶ How to remove liquidity on Rootstock

¶ 1. Access the dapp

- Go to https://sovryn.app to access the dapp.

¶ 2. Connect your wallet

- On the right top, connect your wallet by clicking the Get started button.

¶ 3. Select Earn → Market making

- From the top navigation menu, select the Earn tab and then the Market making option.

¶ 4. Withdraw liquidity and confirm the associated transaction

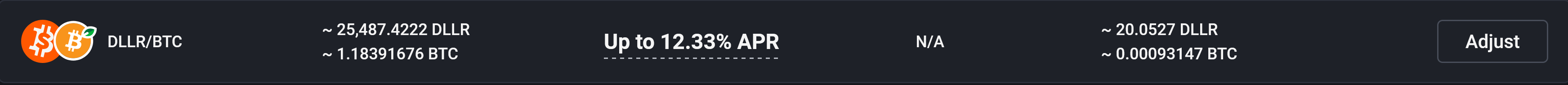

- On the Market making page, select the pool of your choice and click the Adjust button on the right. In the example made for this step, we chose the DLLR/BTC option.

- In the following pop-up window, enter the Withdrawal amount, double check your entries, and click the Withdraw button.

Remember that the withdrawal is made in a 1:1 ratio with its paired asset and you can withdraw only as much (or lower) as you originally deposited. For the interaction with the LP contract, you will need a small amount of BTC for withdrawing funds out of the LP contract. - Confirm the withdrawal using your wallet.

Please be advised that the current transaction fees should be in the range of 0.026 GWEI.

Congratulations! You have successfully completed the liquidity withdrawal.

¶ How to remove liquidity on the Alpha dapp

Note that you can also remove liquidity on the newer dapp.

¶ 1. Access the Sovryn Alpha dapp

- Go to https://alpha.sovryn.app to access the Sovryn Alpha dapp.

¶ 2. Connect your wallet

- On the right top, connect your wallet by clicking the Connect Wallet button.

¶ 3. Select Earn → Pool

- From the top navigation menu, select the Earn tab and continue with the Pool option.

¶ 4. Withdraw liquidity and confirm the associated transaction

- On the Yield Farm page, select the pool of your choice and click the Withdraw button on the right. In the example made for this step, we chose the DLLR/RBTC option.

- In the following pop-up window, enter the Withdrawal amount, double check your entries, and click the Withdraw button.

Remember that the withdrawal is made in a 1:1 ratio with its counterpart asset and you can withdraw only as much (or lower) as you originally deposited. For the interaction with the LP contract, you will need a small amount of RBTC for withdrawing funds out of the LP contract. - Confirm the withdrawal using your wallet.

Please be advised that the current transaction fees should be in the range of 0.026 GWEI.

Congratulations! You have successfully completed the liquidity withdrawal.

¶ How to adjust liquidity or claim fees on BOB

¶ 1. Access the dapp

- Go to https://sovryn.app to access the dapp.

¶ 2. Connect your wallet

- On the right top, connect your wallet by clicking the Get started button.

¶ 3. Select Earn → Market making

- From the top navigation menu, select the Earn tab and then the Market making option.

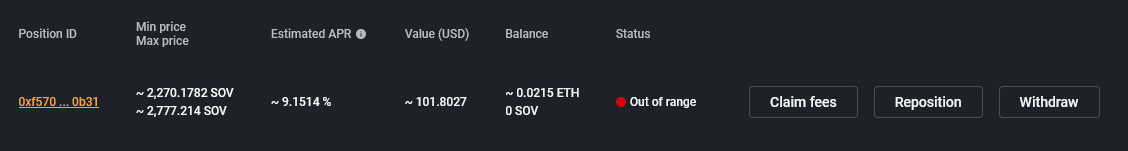

¶ 4. Claim fees, reposition, or withdraw

- On the Market making page, click the bar corresponding to the pool of your choice. It will reveal information and options.

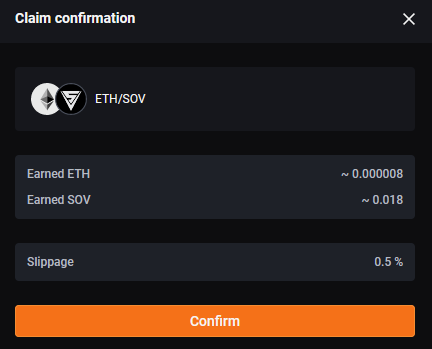

¶ a. Claim fees

- Click the Claim fees button. This will bring up the following dialogue:

- Simply click Confirm and then confirm in your wallet.

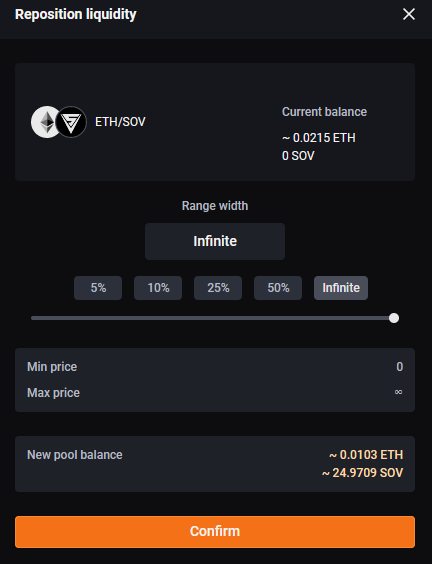

¶ b. Reposition

- Click the Reposition button. This will bring up the following dialogue:

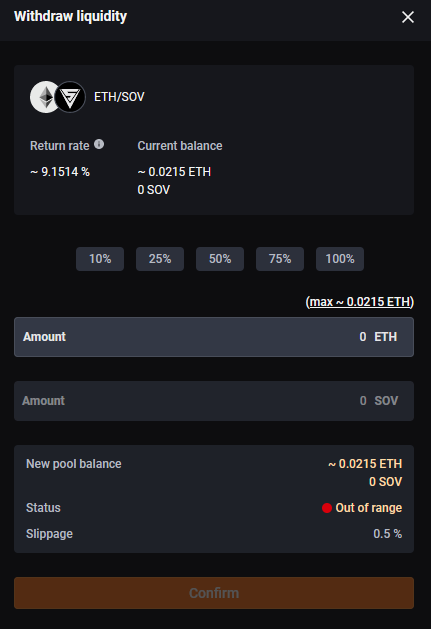

- Select the percentage you want. The min and max prices will update accordingly. Your position will be rebalanced as indicated in the New pool balance so that the assets are again balanced 50/50.

¶ c. Withdraw

- Click the Reposition button. This will bring up the following dialogue:

- Enter the Withdrawal amount, double check your entries, and click the Confirm button.

¶ 5. Confirm the adjustment in your wallet

Congratulations! You have successfully completed the liquidity withdrawal.

¶ Pooled asset token addresses

You can add the following token addresses as a custom token in your Rootstock wallet, which will allow you to see your pooled asset LP token amounts.

Note that if you deposited to your liquidity pool through the dapp and the pool is paying liquidity rewards, the LP tokens are transferred to the liquidity mining smart contract to participate in paying out the rewards. In that case the LP token balance will not appear in your wallet even after you've added the addresses. However, you should see your balance of each asset and the accumulating SOV rewards in the dapp on the yield farm page on Sovryn Alpha dapp or the market-making page on the Sovryn dapp.

¶ Sovryn AMM (separate tokens for one-sided pools)

USDT-RBTC pool:

- USDT: 0x40580E31cc14DbF7a0859f38Ab36A84262df821D

- RBTC: 0x9c4017D1C04cFa0F97FDc9505e33a0D8ac84817F

DOC-RBTC pool:

- DOC: 0x2dc80332C19FBCd5169ab4a579d87eE006Cb72c0

- RBTC: 0x840437BdE7346EC13B5451417Df50586F4dAF836

BPRO-RBTC pool:

- BPRO: 0x9CE25371426763025C04a9FCd581fbb9E4593475

- RBTC: 0x75e327A83aD2BFD53da12EB718fCCFC68Bc57535

¶ Bancor V1-Type AMM (single token for two-sided pools)

DLLR-RBTC pool:

- 0x3D5edf3201876Bf6935090c319fe3ff36eD3d494

SOV-RBTC pool:

- 0x09c5faf7723b13434abdf1a65ab1b667bc02a902

XUSD-RBTC pool:

- 0x6f96096687952349Dd5944e0eb1Be327dcDeb705

FISH-RBTC pool:

- 0x35A74a38Fd7728F1c6BC39aE3b18C974b7979ddD

BNB-RBTC pool:

- 0x8f3d24ab3510294f1466aa105f78901b90d79d4d

ETH-RBTC pool:

- 0xF41Ed702df2B84AcE02772C6a0D8AE46465aA5F4

MOC-RBTC pool:

- 0x7fef930ebaa90B2f8619722AdC55e3f1d965b79b

RIF-RBTC pool:

- 0xAE66117C8105a65D914fB47d37a127E879244319

MYNT-RBTC pool:

- 0x36263AC99ecDcf1aB20513D580B7d8D32D3C439d

POWA-RBTC pool:

- 0xBfd61419D30650FD943855b2bbE4C2A2E54857f9

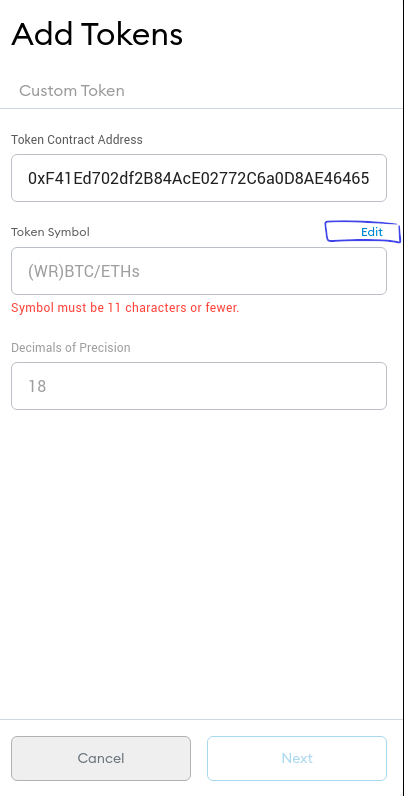

NOTE: You may get a notice that the Token Symbol needs to be less than 11 characters. To resolve this, click the edit button as shown in the image below, then delete any characters of your choice to get the character count to 11 or less.

¶ Disclaimer

- DISCLAIMER: Nothing on this page should be taken as investment advice. The inclusion of a third-party app or service does not constitute an endorsement of the app or service by Sovryn developers or anyone else in the Sovryn community and is provided for informational purposes only. If you have any problems with the listed third-party apps or services, please contact the maintainer of that app or service for help. Sovryn does not control your funds in any supported Web3 wallet. You are entirely responsible for your wallet security. Please do your own research and ensure you understand and accept the risks before trading or using any apps or services to store your funds.