¶ What is XUSD?

XUSD is a USD-pegged stablecoin aggregator of the Babelfish protocol. Its purpose is to act as a "trustless stablecoin translation device" - meaning it facilitates the conversion of multiple USD-pegged stablecoins with each other at a fixed 1:1 ratio. This functionality is operational using Sovryn's Ethereum and BSC bridges, where users can convert many stablecoins from Ethereum and BSC blockchains to Sovryn XUSD on the Rootstock chain.

The list of convertible stablecoins:

- DLLR

- DOC

- DAI

- USDT

- USDC

To see the current composition of XUSD, visit the XUSD Composition chart.

XUSD already has important use cases, which will be improved further over time as Sovryn and Babelfish continue to realize the Babelfish vision—a multi-chain, aggregated "liquidity lake," coordinated via decentralized futarchy governance.

- Learn more about Babelfish and the vision of XUSD here.

XUSD contract address (Rootstock mainnet) - 0xb5999795BE0eBb5BAb23144Aa5fD6a02d080299f

Don't trust, verify:

- https://wiki.sovryn.app/en/technical-documents/mainnet-contract-addresses

- https://rootstock.blockscout.com/address/0x1440d19436bEEaf8517896bffB957A88ec95a00F?tab=tokens#address-tabs

¶ Why do we need XUSD?

- Reduce risk - Currently, the two largest USD-pegged stablecoins by market cap—USDT and USDC—account for ~90% of the USD stablecoin market. Moreover, these two stablecoins are responsible for ~90% of daily trading volume (as of 23 February 2024). Along with this impressive market dominance comes systemic risks. If one of the top stablecoins is compromised, whole marketplaces and platforms (like Sovryn) could be affected severely. By pooling liquidity from multiple networks and approved providers, the potential impact of one stablecoin being compromised is reduced.

- Deepen liquidity - Before XUSD, Sovryn exclusively used rUSDT as the stablecoin of choice for the platform. This worked very well and operated as expected, providing a secure USD-pegged token for users to trade with on Sovryn, as well as improving awareness of the Rootstock ecosystem and its role in DeFi on Bitcoin. However, using only one stablecoin limited the potential liquidity that could flow into Sovryn. By using XUSD, more liquidity can be injected from multiple chains and providers, allowing users more options to bring liquidity onto Sovryn and increasing the platform's total liquidity. The key to using this newfound liquidity is the aggregation of XUSD. If Sovryn were to accept other stablecoins and create a new AMM pool for each stablecoin on the platform, liquidity would be spread thin over those many pools, leading to high slippage and failure of functionality in closing margin and lending positions. By aggregating multiple incoming stablecoins into one token, only one new AMM pool (XUSD-BTC) is needed. A single AMM pool results in far deeper stablecoin liquidity on Sovryn, leading to lower slippage and healthier trading tool functionality.

- Ease of use - XUSD allows users to bridge multiple stablecoins—DAI, USDT, USDC—from the Ethereum and BNB Smart Chain networks as well as DLLR and DOC Rootstock-native stablecoins to XUSD, for use in the Sovryn ecosystem. It also allows users to bridge their stablecoins out of Sovryn just as easily through the Ethereum bridge or the BSC bridge. If you want to provide liquidity from USDT on BSC and exit into DAI on Ethereum, the XUSD bridge allows you to do that. If you want to take profits into USDC on BSC or USDT on Ethereum, all you need to do is use the Sovryn bridge on your portfolio page to transfer XUSD.

¶ XUSD use cases

XUSD currently serves the following use cases on Sovryn:

- Aggregate DAI, USDT, and USDC from the bridges and DLLR and DOC Rootstock-native stablecoins

- Bridging out to Ethereum and BSC to DAI, USDT, and USDC

- Open margin trades using XUSD

- Swap to and from XUSD and other tokens with the Sovryn AMM

- Lend to earn interest on your XUSD

- Borrow XUSD to increase purchasing power

- Use XUSD as collateral when borrowing other tokens

¶ How to obtain XUSD

- Swap another token for XUSD in Sovryn Swap on the alpha dapp

- Bridge stablecoins to XUSD from your Portfolio

- Guide to using the Ethereum bridge

- Guide to using the BSC bridge

- Convert rUSDT to XUSD from your Portfolio

- Convert DLLR to XUSD on the dapp Convert page

¶ How to use the rUSDT to XUSD converter

1 - On the Portfolio page, connect your wallet

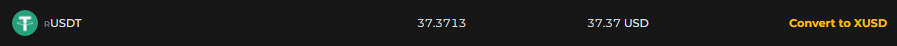

2 - Click the Convert to XUSD button on the rUSDT row

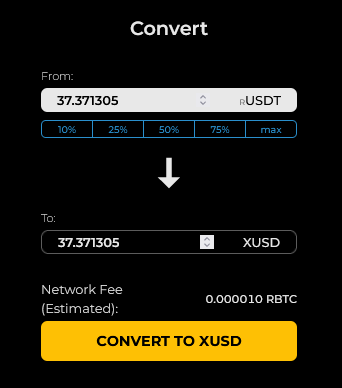

3 - Select an amount of rUSDT to convert and check the network fee amount. The conversion will be done at a 1:1 ratio.

4 - Click the CONVERT TO XUSD button and approve the transactions in your wallet

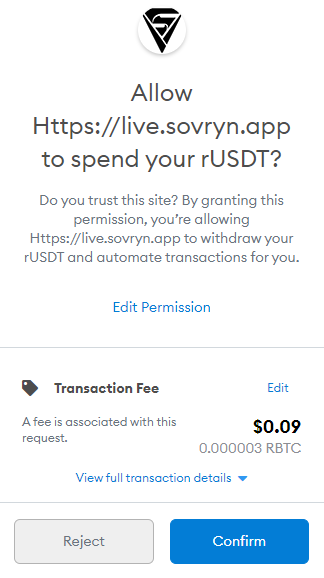

- There may be two transactions to confirm, the first to authorize spending rUSDT on Sovryn if you have not done so already and the second to authorize the actual conversion transaction:

¶ How to send stablecoins using XUSD

You can send XUSD and have it converted to DAI, USDT, or USDC on Ethereum or BSC. To send XUSD to another chain, go to your Portfolio and follow the instructions for using the Sovryn crosschain bridge. See the Step-by-Step Guide to using the Sovryn Crosschain Bridge for detailed guidance.