¶ Note that limit orders are now disabled for both spot and margin trading.

¶ What is trading?

Trading is a fundamental activity of any free economy, involving the buying and selling of goods or services between two parties. Humanity has come a long way from trading with seashells, using salt as a currency, and leaving the gold standard for a fiat-based system. While trading has evolved greatly, the core principles have remained a constant.

In financial markets, ‘trading’ refers to the buying and selling of assets such as:

» stocks » bonds » currencies » commodities » options » futures » margin products » and others

Until recently, such trading existed only in centrally controlled environments such as exchanges and banks. Such institutions fully control the rules and help form the laws within such a system. These rules and laws typically benefit the bigger players, which are often rewarded with bigger discounts and privileges. Centrally controlled institutions have a central point of failure.

Sovryn affords users the ability to trade in a permissionless, noncustodial, and censorship-resistant way.

¶ Swaps on Sovryn

¶ Overview

A swap is an instant and simple trade of one asset (X) for another asset (Y). Performing swap trades on Sovryn is quick and easy. Simply select the asset and quantity you want to swap from (X), then select the asset you want to receive (Y). The Automated Market Maker **(**AMM) will calculate the amount of the asset you wish to receive (Y), minus a small transaction fee for the swap service.

Note that the only way to trade on BOB currently is with swaps (Convert) on the dapp (D2). Trading on BOB is not possible using the Sovryn Alpha dapp.

Use this video explainer, or follow the Swapping Tokens - Step-By-Step guide located below.

https://www.youtube.com/watch?v=3K4ZExSpgW0

¶ Swapping tokens - step-by-step

¶ 1. Access the Sovryn dapp

- Go to https://sovryn.app to access the Sovryn dapp.

¶ 2. Connect your wallet

- A web3 wallet is required to connect with the Sovryn dapp. If you do not already have a web3 wallet configured to connect to Sovryn, visit the Wallet Setup Guide section before proceeding further. On the top-right of the screen, connect your wallet by clicking the Get started button. If you've previously connected, click the Connect Wallet button.

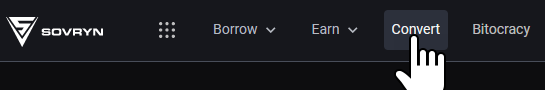

¶ 3. Select Convert

- From the top navigation menu, select the Convert tab.

The main swapping interface is displayed.

¶ 4. Define the input and output of the conversion

- Using the Convert from dropdown, choose a token you own and specify the amount you wish to swap for another token.

- Using the To dropdown, choose the final token you would like to swap for.

The amount of tokens you will receive from this operation is then displayed automatically based on the current market price. - NOTE that just below the Amount to Receive, you can see the Minimum received amount of tokens you are guaranteed to receive from this swap. This amount estimation is calculated by taking the current system price conversion accounting for the maximum slippage that could occur during the swap.

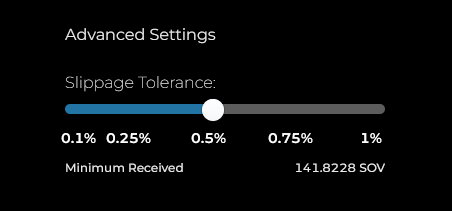

Slippage refers to the difference between the expected price of a trade and the price at which the trade is executed. Slippage can occur at any time but is most prevalent during periods of higher volatility when market orders are used. By default, this slippage is set to 0.5%, which means that users will obtain a minimum of 99.5% of their swapped funds. This additional adjustment is here to help a user finish the swap quickly and easily. Slippage occurs when:- in centralized markets, the Bid price of a seller differs from the Ask price of a buyer.

- in decentralized, AMM markets like Sovryn, a large trade is processed (changing the system price) between the time a user submits a swap order and the time it is actually executed. This effect can be seen even if the trade is your own current trade; the trade itself moves the price as the trade swaps assets.

- If you wish, adjust the slippage rate by clicking Advanced settings in the Convert pane. Consider raising the slippage limit if a swap with a lower slippage rate was unsuccessful. The slippage tolerance does not change the behavior of the market. It only changes the condition under which the trade will be executed.

¶ 5. Confirm your transaction

-

Confirm the swap in the dapp.

-

Confirm the swap using your wallet.

-

Please be advised that the current transaction fees should be in the range of 0.065 Gwei.

Congratulations! You have successfully completed a token swap on the Sovryn platform.

¶ Swapping tokens on the Alpha dapp - step-by-step

Note that swapping on BOB is only available on the newer dapp.

¶ 1. Access the Sovryn Alpha dapp

- Go to https://alpha.sovryn.app to access the Sovryn Alpha dapp.

¶ 2. Connect your wallet

- A web3 wallet is required to connect with the Sovryn dapp. If you do not already have a web3 wallet configured to connect to Sovryn, visit the Wallet Setup Guide section before proceeding further. On the top-right of the screen, connect your wallet by clicking the Connect Wallet button.

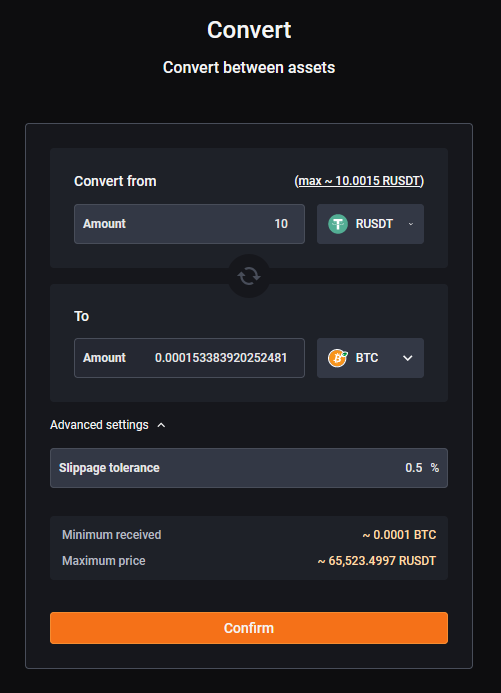

¶ 3. Select Trade → Swap

- From the top navigation menu, select the Trade tab and continue with the Swap option.

The main swapping interface is displayed.

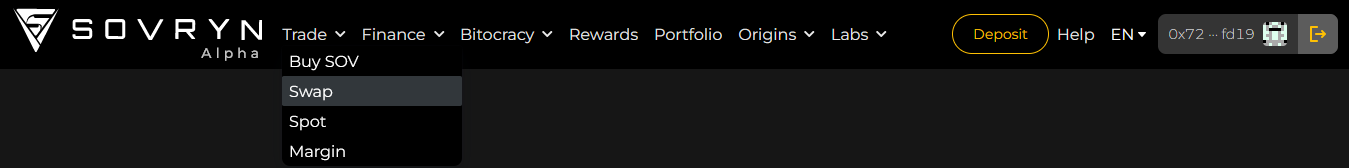

¶ 4. Define the input and output of the swap

- Using the TOKEN TO SWAP tab on the left, choose a token you own and specify the amount you wish to swap for another token.

- Using the TOKEN TO RECEIVE tab on the right, choose the final token you would like to swap for.

The amount of tokens you will receive from this operation is then displayed. - NOTE that just below the Amount to Receive, you can see the Minimum received amount of tokens you are guaranteed to receive from this swap. This amount estimation is calculated by taking the current system price conversion accounting for the maximum slippage that could occur during the swap.

Slippage refers to the difference between the expected price of a trade and the price at which the trade is executed. Slippage can occur at any time but is most prevalent during periods of higher volatility when market orders are used. By default, this slippage is set to 0.5%, which means that users will obtain a minimum of 99.5% of their swapped funds. This additional adjustment is here to help a user finish the swap quickly and easily. Slippage occurs when:- in centralized markets, the Bid price of a seller differs from the Ask price of a buyer.

- in decentralized, AMM markets like Sovryn, a large trade is processed (changing the system price) between the time a user submits a swap order and the time it is actually executed. This effect can be seen even if the trade is your own current trade; the trade itself moves the price as the trade swaps assets.

- If you wish, adjust the slippage rate using the gear wheel icon, located above the SWAP button**.** Consider raising the slippage limit when a swap with a lower slippage rate was unsuccessful. The slippage tolerance does not change the behavior of the market. It only changes the condition under which the trade will be executed.

¶ 5. Confirm your transaction

-

Confirm the swap in the dapp.

-

Confirm the swap using your wallet.

-

Please be advised that the current transaction fees should be in the range of 0.065 Gwei.

Congratulations! You have successfully completed a token swap on the Sovryn platform.

¶ Spot trading on Sovryn

¶ Overview

Spot trading is buying or selling an asset you own outright to own the actual received asset outright. Spot trading on Sovryn is a way of simply trading the actual assets without using leverage and a margin contract. Trades are picked from the available asset pairs. Traders can place Buy or Sell orders as market orders or limit orders. A market order is an order to buy or sell a specific quantity at the best available price – the market price. Since a market order puts no restriction on the price at which an asset can be sold or bought, the transaction occurs as soon as the order is placed. A limit order is an order to buy or sell up to a specific quantity at a price specified by the trader – the limit price. Unlike a market order, a limit order is not ordinarily executed immediately but must await market action to bring the price in line with the limit price. Limit orders on Sovryn can be set to expire after a specified time if they are not filled before the expiration.

Use this video explainer, or follow the Spot Trading - Step-By-Step Spot guide located below.

https://www.youtube.com/watch?v=oF3I-ngNslA

¶ Spot trading - step-by-step

¶ 1. Access the Sovryn Alpha dapp

- Go to https://alpha.sovryn.app to access the Sovryn Alpha dapp.

¶ 2. Connect your wallet

- A web3 wallet is required to connect with the Sovryn dapp. If you do not already have a web3 wallet configured to connect to Sovryn, visit the Wallet Setup Guide section before proceeding further. Otherwise, connect your wallet by clicking the Connect Wallet button (upper right-hand corner).

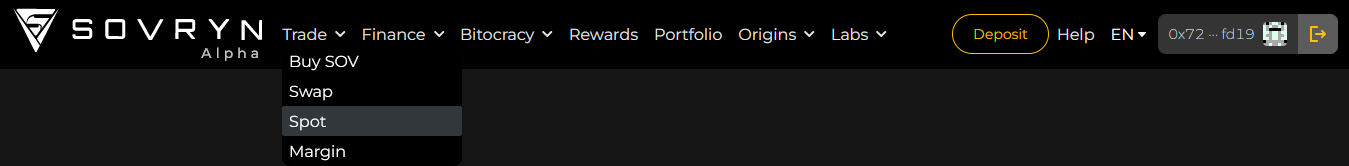

¶ 3. Select Trade → Spot

- From the top navigation menu, select the Trade tab and continue with the Spot option.

The main Spot interface is displayed.

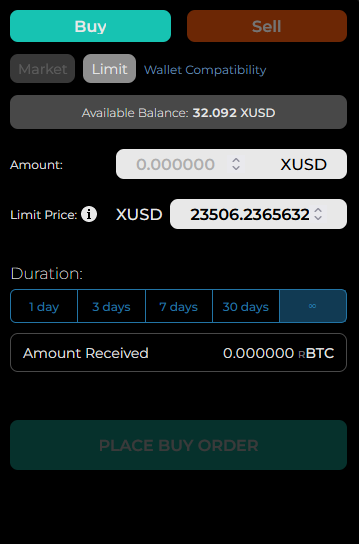

¶ 4. Set up a spot trade

- A - Select the desired trading pair using the drop-down menu in the upper left.

- B - Observe the price chart for the current spot price and select BUY or SELL (see figure below).

- C - Specify the Amount you want to use for setting up a trade.

- D - Select Market or Limit order.

- For a market order:

- 1 - Observe the Amount Received value, which is an approximation of the trade outcome.

- 2 - The Minimum received amount displays the Amount Received value considering slippage. Higher slippage may result in a trade being executed more swiftly but with a lower Amount Received. Use the gear-wheel icon to set the slippage to match your preferences, or use the platform default value of 0.5%.

- For a Limit Order:

NOTE:

- Limit order currently have some known limitations. These limitations should be reviewed before placing a limit order.

- 1 - Specify the Limit Price – below market for a buy and above market for a sell.

- 2 - Observe the Amount Received value, reflecting the trade outcome if the full order is filled.

- 3 - If you would like the limit order to expire after a set period, select the Duration. By default, the order does not expire (infinity).

¶ 5. Execute the trade

- Verify your selections.

- For a market order, adjust the slippage tolerance (optional).

- Once satisfied, click PLACE BUY/SELL ORDER – green if a buy and red if a sell.

¶ 6. Confirm your transaction

- After placing the spot trade order, confirm your transaction in the dapp.

- Confirm the transaction using your wallet.

- For a limit order, sign the transaction using your wallet after confirming.

- Please be advised that the current transaction fees should be in the range of 0.065 Gwei. for a market order. Limit orders are not executed immediately. No gas fees are charged for submitting the order because the order is executed on the Rootstock testnet. If the limit order is filled, gas and slippage are included in the price you receive and no gas is explicitly charged.

¶ 7. Receive notifications for limit orders

- To receive notifications that your limit orders have filled, click the Notification button in the upper right corner of the dapp. For more details, see Trade Notifications.

- Turn on email notifications, enter your email address, and Confirm. Then sign with your wallet.

- Sovryn goes to great lengths to protect your privacy. Emails never contain references to transaction amounts or transaction IDs. Your email address is saved in encrypted form, and the associated Rootstock address is stored in a hashed format to obscure its purpose.

- You can turn off email notifications by clicking the switch after clicking the Notification button in the dapp. You can also click one of the unsubscribe links in the email you receive. One of the links in the email will unsubscribe notifications for the specific Rootstock address that email message is associated with. The other link will completely remove your email address from the Sovryn email notification system so you won’t receive email notifications regarding any Rootstock address that might be associated with your email address.

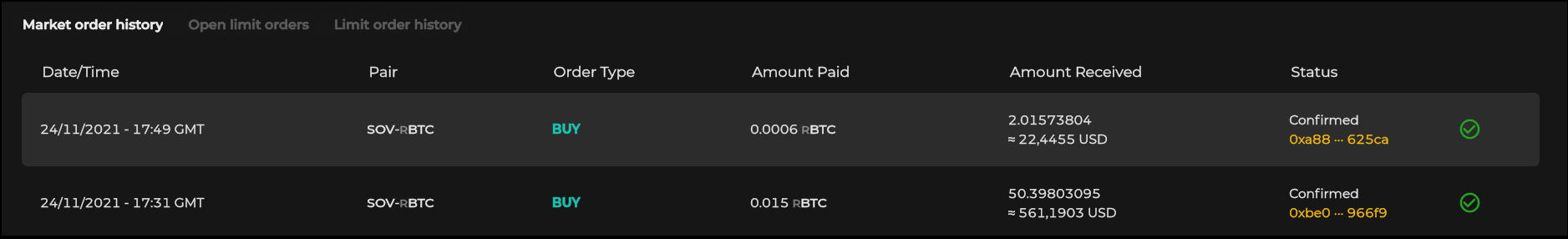

¶ 8. Observe the spot transaction history

- Access the spot transaction history at the bottom of the spot trading page. You can view market order and limit order fills as well as limit orders that are pending.

¶ Margin trading on Sovryn

¶ Overview

Margin trading is a more sophisticated form of trading. Margin trading allows you to control more assets than you would be able to buy or sell outright. You use assets in your wallet as collateral for your margin to borrow more assets or increase your initial position. For this loan, you need to pay interest, as somebody is providing these assets for you to use, and the platform facilitates this. The interest paid will differ with market movements, so it is important to be aware of the current interest rate when you enter or maintain a position. You can keep your position open as long as your collateral is higher than the accumulated loss on the amplified position.

Use this video explainer, or follow the Margin Trading - Step-By-Step Spot guide located below.

https://www.youtube.com/watch?v=YT2ooxPdGOM

¶ Leverage on Sovryn

Leverage is the amount you amplify your margin with. When you use 4x leverage you increase your initial margin by four times, which provides you with a position 4x larger than you could control by buying or selling outright. As a result of the increased position, the gains or losses are also amplified by your chosen leverage. This is very beneficial when the market moves according to your expectations as your profit is multiplied. However, if the market moves against you, your losses will also be multiplied. When losses occur, you must repay your debt for the initial loan.

To ensure that you have sufficient funds to repay your loan, the system requires a threshold amount of assets called maintenance margin. This is the minimum account balance (margin) you must maintain before you are forced to deposit more funds into the position or close the position to pay off your loan. For every margin position, there is a defined price when this happens, called the liquidation price. When the liquidation price is reached the system will automatically sell your position at a loss to protect you against being unable to repay your loan. As you can see, margin trading is more complex than spot trading; it has the potential for increased profits and losses.

¶ Long or short

When margin trading, you have the option to open a leveraged long position if you anticipate an increase in price, or you can open a short position if you expect a decrease in price.

When you open a leveraged position (long or short), you are technically borrowing assets to increase your position size. Your borrowed assets plus interest are automatically repaid when you close your position or if the position becomes liquidated.

¶ Margin trading - step-by-step

¶ 1. Access the Sovryn Alpha dapp

- Go to https://alpha.sovryn.app to access the Sovryn Alpha dapp.

¶ 2. Connect your wallet

- A web3 wallet is required to connect with the Sovryn dapp. If you do not already have a web3 wallet configured to connect to Sovryn, visit the Wallet Setup Guide section before proceeding further, otherwise connect your wallet by clicking the Connect Wallet button (upper right-hand corner).

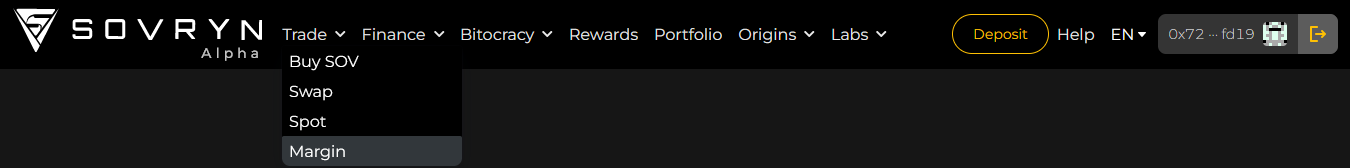

¶ 3. Select Trade → Margin

- From the top navigation menu, select the Trade tab and continue with the Margin option.

The main Margin interface is displayed.

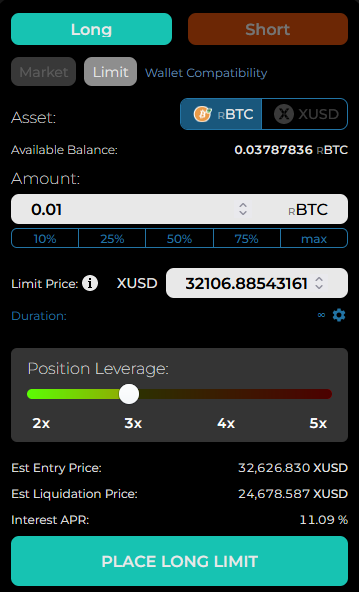

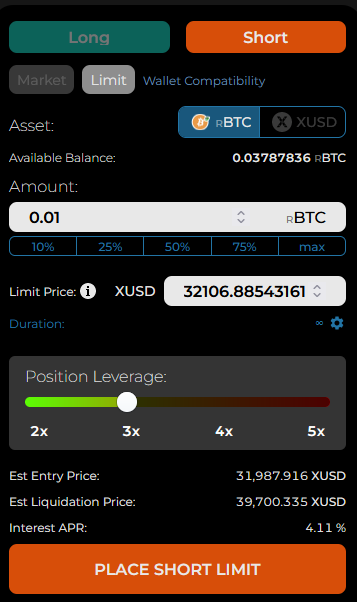

¶ 4. Set up a margin trade

- A - Select the desired trading pair using the drop-down menu in the upper left.

- B - Observe the price chart for the current price and select LONG or SHORT. (LONG is the only option for SOV.)

- C - Choose the Asset from the trading pair that you would like to use as collateral for your position.

- C - Set desired leverage of 2x, 3x, 4x, or 5x using the Leverage slider. (SOV only allows 2x.)

Notice that when you select higher leverage, the liquidation price changes to a higher price. - D - Select Amount to trade with.

- E - Select Market or Limit order.

- For a market order: (Note: Limit orders are only available on testnet at this time.)

- 1 - Observe the Amount Received value, which is an approximation of the trade outcome.

- 2 - The Minimum received amount displays the Amount Received value considering slippage. Higher slippage may result in a trade being executed more swiftly but with a lower Amount Received. Use the gear-wheel icon to set the slippage to match your preferences, or use the platform default value of 0.5%.

- For a Limit Order:

NOTE:

- Limit order currently have some known limitations. These limitations should be reviewed before placing a limit order.

- 1 - Specify the Limit Price – below market for a buy and above market for a sell.

- 2 - If you would like the limit order to expire after a set period, select the Duration gear wheel and set the duration. By default, the order does not expire (infinity).

¶ 5. Execute the trade

- Verify your selections.

- For a market order, adjust the slippage tolerance (optional).

- Once satisfied, click PLACE LONG/SHORT ORDER – green if a long and red if a short.

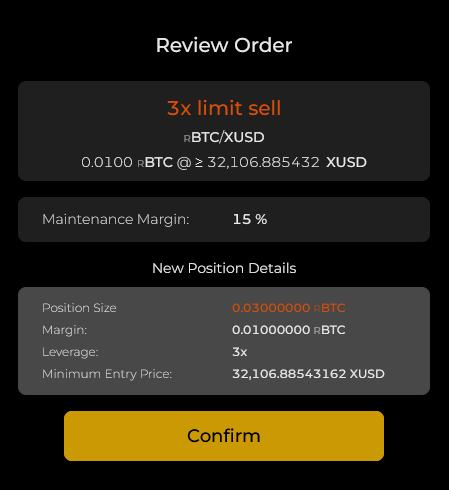

¶ 6. Confirm the trade

- Check the transaction confirmation in the dapp for a summary of your selections.

- Once satisfied, click CONFIRM. (The figure below corresponds to the market buy example figure above.)

¶ 7. Confirm your transaction

- Confirm the transaction using your wallet. Please be advised that the current transaction fees should be in the range of 0.065 Gwei.

- If it is a limit order, you will be asked to sign the transaction rather than confirming it.

¶ 8. Receive notifications for limit orders, margin calls, and liquidations

- To receive notifications of limit order fills, margin calls, and liquidation notification, click the Notification button in the upper right corner of the dapp. For more details, see Trade Notifications.

- Turn on email notifications, enter your email address, and Confirm. Then sign with your wallet.

- Sovryn goes to great lengths to protect your privacy. Emails never contain reference to transaction amounts or transaction IDs. Your email address is saved in encrypted form, and the associated Rootstock address is stored in a hashed format to obscure its purpose.

- You can turn off email notifications by clicking the switch after clicking the Notification button in the dapp. You can also click one of the unsubscribe links in the email you receive. One of the links in the email will unsubscribe notifications for the specific Rootstock address that email message is associated with. The other link will completely remove your email address from the Sovryn email notification system so you won’t receive email notifications regarding any Rootstock address that might be associated with your email address.

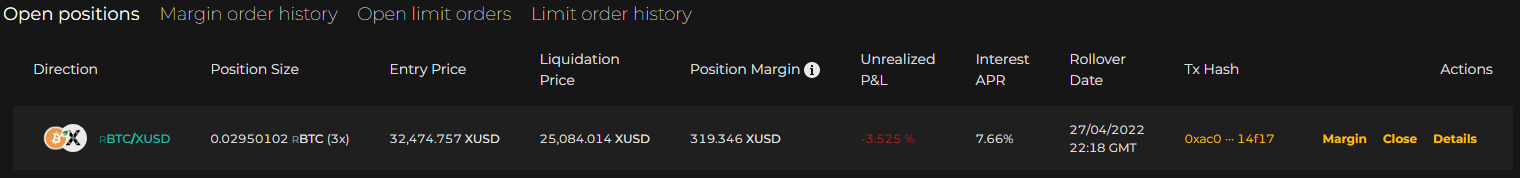

¶ 8. Monitor your trade activity

See the new position detail under Open Positions. Sometimes this is not immediately visible. It should appear if you refresh your page.

In this area you can find detailed information on open positions, both margin market and margin limit order history, and open limit orders. In addition, from this area you can close positions or orders and add margin to existing positions.

¶ Margin notifications and liquidations

If you have set up notifications for margin calls and liquidation notifications, you will get an email notice under the following conditions:

- 2x, 3x leverage positions: Margin falls to 30%.

- 2x, 3x, 4x leverage positions: Margin falls to 25%.

- 2x, 3x, 4x, 5x leverage positions: Margin falls to 20%.

- 2x, 3x, 4x, 5x leverage positions: Margin falls to 15% – partial liquidation.

- 2x, 3x, 4x, 5x leverage positions: Full liquidation.

Each type of margin call will be sent only once per 24 hours to avoid many emails being sent in a short time. If the margin position does not have additional margin added and the position is left open, one email will be sent every 24 hours until it is liquidated or the margin increases. If the margin falls quickly (e. g. from 30% to 20% in a short time), one email for each of the above conditions will be sent in less than 6 hours.

If your margin falls below 15%, your position will be partially liquidated to bring it back up to 20% margin.

The amount liquidated is subject to a 5% penalty that is paid to the node that initiates the liquidation event.

If the price continues to move against you, you will be partially liquidated over and over until the remaining margin reaches a small threshold. At that point all remaining margin is liquidated.

¶ Margin trading mechanics

Either asset in a margin trading pair can be used for margin collateral. Any margin trade can be regarded as going long on one of the assets and short on the other. If the collateral is provided in the short asset, it is first swapped behind the scenes into the long asset.

A loan is then taken out in the long asset to complete the requested leverage in the long asset. If the margin trade is 3X, then two times the collateral is borrowed and combined with the collateral to form a 3X position.

When the margin position is closed, the loan is paid off and the remaining value of the long asset is withdrawn. The value of the position can be taken in either asset of the pair. If the long asset is requested, it is returned directly to the user. If the short asset is requested, the long asset is swapped for the short asset and then returned to the user.

¶ Disclaimer

- DISCLAIMER: Nothing on this page should be taken as investment advice. The inclusion of a third-party app or service does not constitute an endorsement of the app or service by Sovryn developers or anyone else in the Sovryn community and is provided for informational purposes only. If you have any problems with the listed third-party apps or services, please contact the maintainer of that app or service for help. Sovryn does not control your funds in any supported Web3 wallet - you are entirely responsible for your wallet security. Please do your own research and ensure you understand and accept the risks before trading or using any apps or services to store your funds.