¶ What is the Sovryn Dollar?

¶ Introduction

The Sovryn Dollar (DLLR) is an aggregation of purely BTC-backed “constituent” stablecoins into a single stablecoin. Multiple methods of creating BTC-collateralized tokens pegged to BTC are aggregated to create a stablecoin more resilient and scalable than any individual constituent stablecoin. The Sovryn Dollar is produced by Mynt, a smart contract system governed by Sovryn Bitocracy.

¶ Why the Sovryn Dollar?

¶ Motivation

“The root problem with conventional currency is all the trust that’s required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust.”

— Satoshi Nakamoto

The core mission of Sovryn is to continue Satoshi's mission for establishing new territories of freedom by building trustless economic tools on bitcoin. Central to accomplishing this mission is to remove the need for intermediaries or the constraints they can impose.

Bitcoin has emerged as a proven store-of-value over long time frames. However, its day-to-day volatility has limited its use as a medium of exchange or for low-risk savings. The bitcoin whitepaper envisions BTC's use for cash and payments. The Sovryn Dollar provides a path to this by overcoming the volatility problem by creating currency whose value can be reliably stable to a USD peg. If the peg chosen is a fiat currency, the stablecoin can circulate as a substitute for USD, unthreatened by the need to trust intermediaries and secured by the underlying BTC value.

¶ Existing stablecoins are centralized and poorly collateralized

The value and utility of stablecoins has been clearly demonstrated. The many stablecoins on the market have a combined valuation of over $100B USD and are still rapidly growing. The concern with most of these stablecoins is that they rely on central intermediaries and are backed by collateral that is inferior to BTC. A truly decentralized alternative is needed. This need is only becoming more urgent as regulatory actions are increasingly threatening the existing stablecoins and poorly designed and undercollateralized algorithmic stablecoins fail to hold their peg.

¶ BTC-backed stablecoins

Two BTC-backed stablecoins already exist. The first of these is DOC (Dollar on Chain), which has proven to successfully maintain a robust peg. DOC is generated by the Money On Chain protocol, which is the second most used protocol on Rootstock after Sovryn. The success of DOC has demonstrated the demand for BTC-backed stablecoins.

The second stablecoin is ZUSD, which is minted by borrowing using the Sovryn Zero protocol. ZUSD uses overcollateralized borrowing against BTC to fully back the value of the stablecoin.

What then is the need for the Sovryn Dollar?

The Sovryn Dollar will extend and increase the usefulness of DOC and ZUSD, while at the same time improving the resilience of BTC-backed stability as well as increasing the overall liquidity.

¶ Multiple methods of producing stability

There are many methods of producing stable-tokens with collateral. Money On Chain, MakerDAO, and Reflexer are just three examples, and each has a different design with different trade-offs. Money On Chain, for example, allows for atomic (instant) redemption of DOC for BTC. However, it also requires a very high level of collateral, making it difficult to scale.

Other methods of generating stability, such as the Sovryn subprotocol Zero, have different trade-offs. Zero allows for lower collateralization ratios and also for 0% interest loans but does not provide for atomic redemptions in the same way (instant redemptions are possible with a variable redemption fee).

The most important difference between Zero and Money On Chain is that Zero allows for stables to be generated via loans, whereas DOC is created via a conversion (a sale of BTC).

The Sovryn Dollar bundles together these different methods to take advantage of their differing strengths, while at the same time mitigating their weaknesses. This provides for improved peg stability, greater scale, more unique products, and an overall greater market.

¶ Controlling systemic risk

Stablecoins, as a form of currency, play a systemically important role in DeFi systems. Due to the fact that they are so central to the workings of these markets, any weaknesses or centralization that characterizes them is introduced into the entire system. Sovryn is mitigating these risks by setting standards for BTC-backed stablecoins and promoting their use in the Sovryn ecosystem.

To accomplish this, the Sovryn Dollar will be at the center of the Sovryn protocol, and BTC-backed stablecoins should enter into the ecosystem primarily as part of the Sovryn Dollar aggregated stablecoin. In effect, the Sovryn Dollar sets the standards for and promotes the use of BTC-backed stablecoins.

¶ Aggregating methods of stability

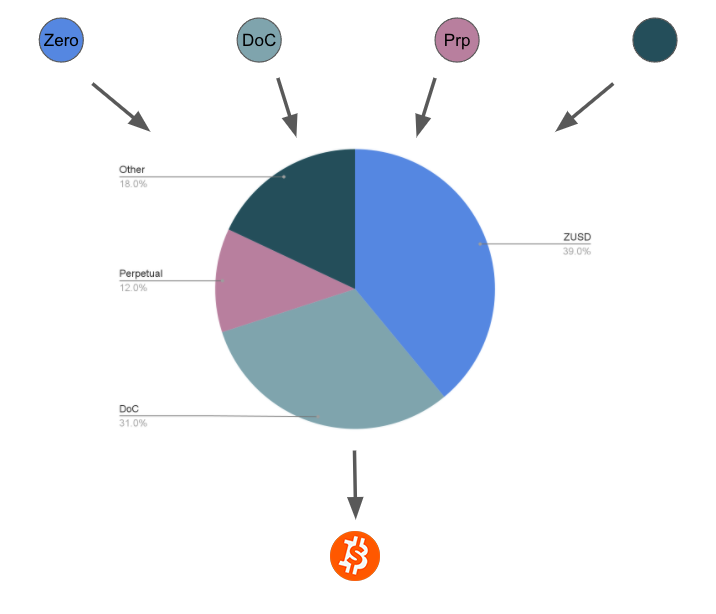

Each of the different systems producing stability that are part of the Sovryn Dollar aggregator produces a token. We will refer to these as constituent tokens, since their primary purpose is to act as part of the collateral that will be wrapped into DLLR minted by the Mynt. A hypothetical example can be seen in the below diagram.

The aggregator can maintain various policies and standards regarding which constituent tokens are allowed to compose the aggregator pool and what weighting they should have.

¶ Where to mint and redeem DLLR

- Sovryn - https://sovryn.app/convert

¶ Where to buy and sell DLLR

- Sovryn Alpha - https://alpha.sovryn.app