¶ Governance on Sovryn

Sovryn's bitcoin-native protocol advances financial sovereignty in a way that aligns with Satoshi Nakamoto's vision of a trustless, censorship-resistant, and peer-to-peer system of money. The founding team created the platform by expanding on proven technological advancements from Ethereum-based DeFi applications while improving known risk elements. The result is an autonomous platform for trading, leveraging, and lending that runs on a bitcoin sidechain, with incentives for long-term growth hard-coded in.

¶ Governance on other DeFi platforms

Ethereum-based DeFi protocols have taken a great leap toward financial sovereignty by enabling trading and lending by aggregation of decentralized exchanges (DEXs). A DEX does not require KYC and allows users to hold their tokens while trading, lending, staking, and providing liquidity. Platforms like Compound and Uniswap were created specifically as decentralized entities directed by governance mechanisms with no central authority. With relatively low effort, participants can vote on the direction of these protocols using their Ethereum-based governance tokens. This mechanism advances decentralization, but it also introduce risks such as the threat of speculative attacks. Compound and Uniswap enable all token holders, regardless of whether they are staking or not, to participate in governance, creating a system where long-term participation is not incentivized. Token holders who have no stake at all can abuse this type of governance model through the use of flash loans, which exploit arbitrage opportunities using large, uncollateralized loans to manipulate and capitalize on volatile token prices. Participants on these platforms hold tokens to gain a vote on protocol proposals but have no long-term incentive to act in the best interest of the platform.

¶ The SOV token

SOV is an ERC-20 token minted on Rootstock. SOV itself does not grant governance rights. Instead, SOV gives the option for the token holder to stake in the Sovryn protocol, which then provides the token holder with governance rights.

SOV is not an "altcoin," a cryptocurrency alternative to BTC. The purpose of SOV is to provide a pseudonymous, censorship-resistant mechanism for governing the parameters of the Sovryn protocol while aligning the incentives of protocol governors with the long-term success of the protocol.

¶ Bitocracy

A Bitocracy is the Sovryn term for an evolved form of a Vetocracy, which is a governance system where no single entity can make decisions or changes to the system. A modern example of a Vetocracy would be the United Nations, which gives each member nation the right to veto. But this type of governance has its limitations, since any one nation can override a majority. Vetocracies are often the result of an inherent lack of trust among the participants and an unwillingness for any of the members to forgo sovereignty.

Sovryn's bitcoin-native mode of governance is a Bitocracy, which gives weighted voting rights to participants based on how much skin in the game they have while aligning the incentives of all participants. Only users who stake SOV ("stakers") receive voting power, and they can stake up to a three-year period. During this staking period SOV liquidity is suspended, thus removing arbitrage opportunities that could lead to abuses of the system. A Bitocracy enables a system of governance appropriate for a self-governing, decentralized platform—where users interact with the blockchain with complete financial sovereignty, enjoying bitcoin-class security and long-term incentives to act in beneficial ways towards the protocol.

¶ Bitocracy in action

Stakers with genuine incentive direct the Sovryn protocol. While other DeFi protocols use a highly decentralized governance model where the more the merrier, Bitocracy values qualified governance involving participants with skin in the game—a genuine stake. At any time, Bitocracy participants may take initiative to improve or expand the protocol, such as by modifying a smart contract, issuing a grant, or offering a bounty. All of these changes must be voted on by the community in a series of steps:

- Participants make a proposal in code.

- Stakers vote on the proposal.

- If the proposal is approved, then an execution delay begins. Anyone who disagrees strongly with the proposal then has this time to leave the protocol before the proposal is executed.

In this system, all staked SOV represents a voice in Bitocracy, but users also have a way to unilaterally exit if they're unhappy with the direction the protocol is taking. Stakers can exit before the end of their staking duration, but they are charged a fee. The longer their remaining staking duration when they exit, the higher the penalty. This penalty incentivizes them to stay for the full duration. Refer to the table of unstaking penalties.

By creating the right set of incentives to promote good governance and minimize threats, Sovryn sets its sights on the long-term viability of a bitcoin-native trading platform. The Bitocracy model ensures that Sovryn can remain a self-sustaining DeFi platform while granting each user full financial sovereignty.

¶ Voting power

To gain voting power, SOV holders must stake their SOV for a given period up to three years. Sovryn uses a quadratic equation with a mapping system to measure the total amount of tokens that are unstaked on any given day. This equation rewards stakers with more voting power the longer they stake, with a significant increase as the staking period approaches three years. The protocol uses this equation to compute the voting power of all the tokens staked up to a given point in time. Staking SOV for voting power is a feature that is permissionless and openly available to anyone. You can read more about the technical details of staking and how voting power is calculated.

¶ Staking SOV

¶ Benefits of SOV staking

SOV staking brings many benefits:

- Bitocracy: Sovryn is not just a protocol but a DAO, governed by those who elect to stake their SOV. SOV stakers vote on all SIPs with voting power based on their staking duration.

- Trading fees: Stakers earn RBTC revenue generated by trading on the Sovryn AMM. Higher trading volume means more revenue shared with SOV stakers. (See Fees in the Sovryn System). Fees accrued in tokens other than RBTC and SOV are converted to RBTC weekly. SOV revenue isn't converted but is paid directly in SOV. All fees are collected from the AMMs weekly and can then be claimed by stakers.

- Zero protocol fees: The Zero protocol distributes fees to SOV stakers in two ways: a) borrowing fees in ZUSD and b) redemption fees in RBTC.

- Early access: Stakers gain early access to pre-sales to project launches.

- Slashing fees: Stakers earn a share of the penalty SOV from users who unstake before the end of their staking period (slashing penalty of up to 30%).

¶ How to stake

¶ 1. Access the dapp

- Go to https://sovryn.app to access the dapp.

¶ 2. Get started

- On the top-right of the screen, click the Get Started button to connect your wallet, and follow the on-screen instructions. If you have not already set up your wallet to connect with the Sovryn dapp, visit the Wallet Setup Guide section before proceeding further.

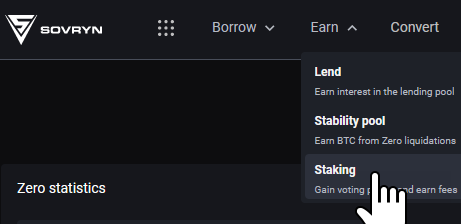

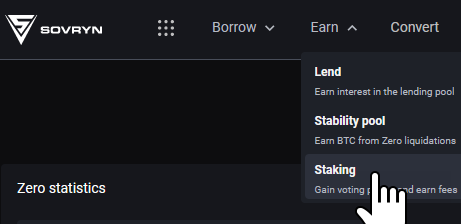

¶ 3. Select Earn → Staking

- From the top navigation menu, select the Earn tab and then the Staking option.

¶ 4. Stake SOV

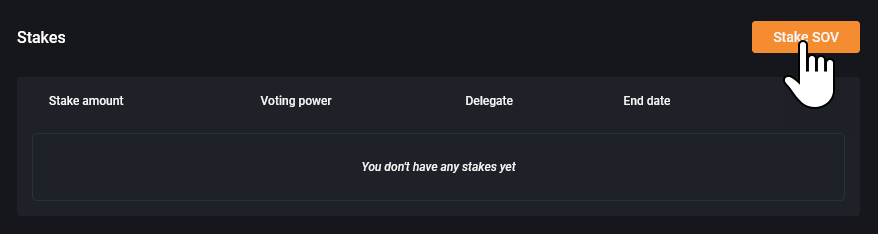

Once the wallet is connected, the Staking/Vesting page will appear. This page provides an overview of:

- Total staked SOV

- Total voting power

- Personal staking statistics

- Personal stakes

- Personal vesting stakes

To start staking, click Stake SOV. If you already have stakes, the button to click will say Add new stake.

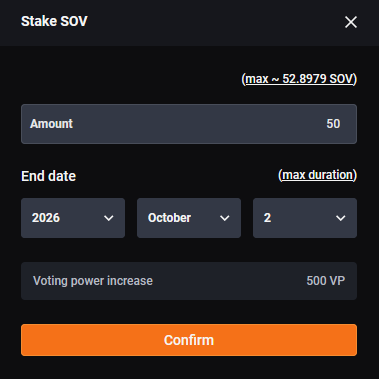

¶ 5. Stake options

A stake SOV modal will pop up. Select the amount of SOV you want to stake and the end date of your staking period. Your voting power will be calculated and displayed based on your selections. Verify your selections; once satisfied, click Confirm. In our example, we stake 50 SOV until 2026-Oct-2, which results in voting power of 500.

You will be prompted by your wallet to confirm the transaction.

- Please be advised that the current gas price in the Rootstock network should be in the range of 0.065 GWEI.

- NOTE: Learn more about gas here.

- Staking is done in two transactions:

- The first transaction will approve the staking contract to withdraw SOV from your address.

- The second one will place your SOV into the contract.

Congratulations! You have successfully staked SOV on Sovryn.

¶ How to claim staking rewards

¶ 1. Access the dapp

- Go to https://sovryn.app to access the dapp.

¶ 2. Get started

- On the top-right of the screen, click the Get Started button to connect your wallet, and follow the on-screen instructions. If you have not already set up your wallet to connect with the Sovryn dapp, visit the Wallet Setup Guide section before proceeding further.

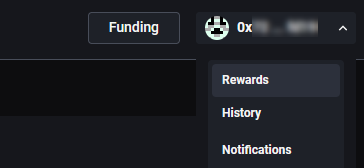

¶ 3. Select Rewards

- On the top right of the screen, click your wallet address field with the dropdown arrow and select Rewards.

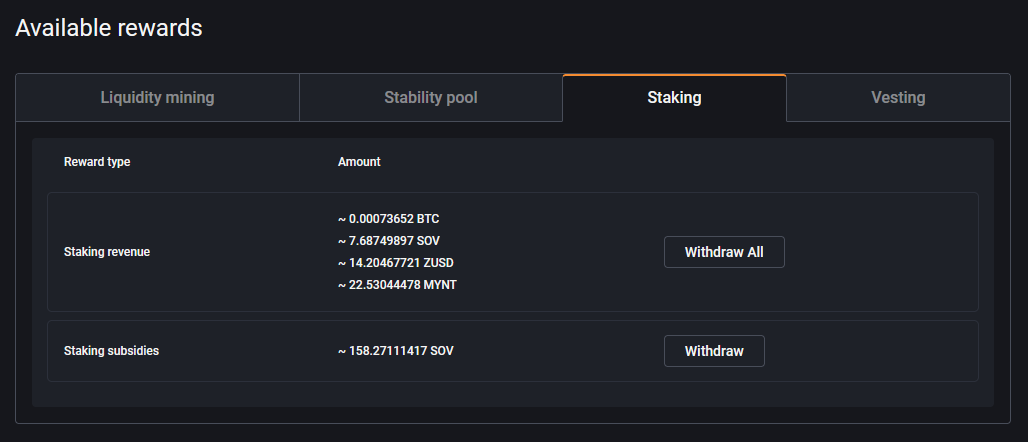

¶ 4. Withdraw staking rewards

- On the resulting table, select the Staking tab. Then select Withdraw All to withdraw staking revenue and Withdraw to withdraw any staking subsidies you may have. In both cases you will need to confirm in the dapp and then with your wallet.

¶ Voting

The governance of Sovryn depends entirely on SOV stakeholders exercising their right to vote. It is important to understand what you are voting on fully. For that reason, Sovryn produces SIPs (Sovryn Improvement Proposals) as informational explainers detailing the proposals in the upcoming vote. Examples of past SIPs can be found on the Bitocracy page.

As a community-driven project, your vote matters. As an SOV stakeholder, your vote is your voice and your right. You truly make a difference in the development and direction of Sovryn.

Here are just a few of the many reasons why you should vote:

- SIPs have consequences. Every SIP is significant, which is why SIPs require a community vote to pass. As a stakeholder, you have the ability to participate in the direction of Sovryn, not just for yourself but for the entire community. Voting enables you to take a stand for the issues you care about. You are an integral part of this project—exercise your right to help decide what's best.

- Not voting is giving up your voice. The direction of the Sovryn project is decided by the people who vote. If you don't vote, others make the decisions for you. Your vote is your voice.

- Your SOV is your voice. Voting is your chance to decide how SOV is utilized, allocated, and distributed.

- Voting is an opportunity for change. It gives you the ability to make a positive impact. Support the measures and proposals that you believe will help the Sovryn community, and oppose the ones you strongly object to. The objective is to move the project forward for the greater good. Do your part, and make your voice heard!

- The Sovryn community depends on you! It is made up of people from all walks of life, from all corners of the world. Some may not value the importance of voting, while others may not fully appreciate the privilege. In that sense, when you vote, you do so not only for yourself but for the benefit of others as well.

¶ How to vote

Voting within the Sovryn Bitocracy protocol is a simple process.

¶ 1. Connect your wallet

NOTE: If you have not already set up your wallet to connect with the Sovryn dapp, please visit the Wallet Setup Guide before proceeding.

- Connect your wallet by clicking on the Connect Wallet button on the right top.

¶ 2. Go to the bitocracy page on the dapp

- Visit the Sovryn Bitocracy page or select Bitocracy from the top menu on the dapp.

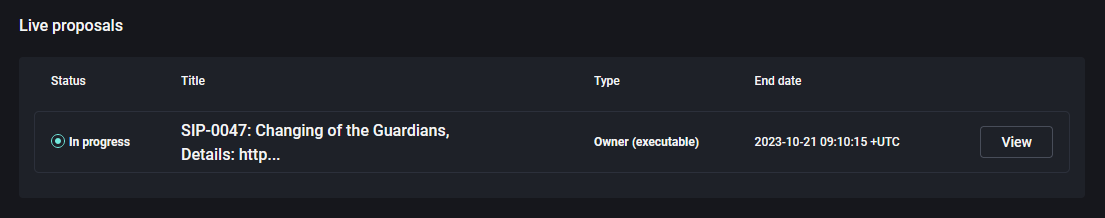

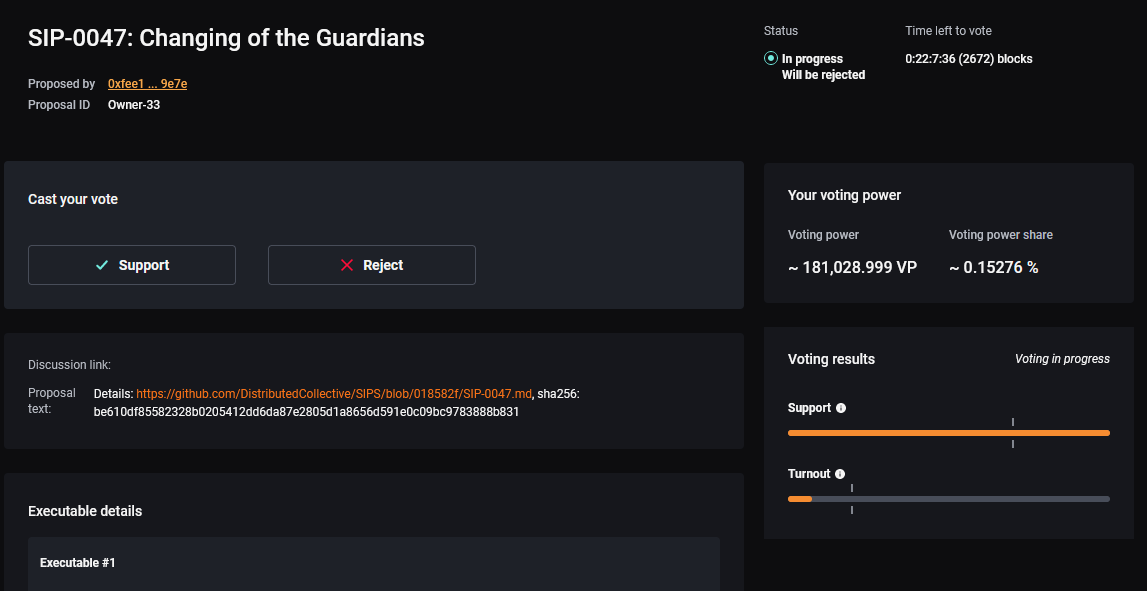

- The Sovryn Bitocracy page opens up with the list of SIPs. If there are any proposals to be voted on, a Live proposals section will appear at the top. Find the active SIP you want to vote on and click the View link.

¶ 3. Cast your vote

IMPORTANT: Carefully review the SIP and do extra research if necessary. Your vote matters! You can read the details of the proposal by following the Proposal link below the vote buttons.

- You can either vote to Support or Reject the SIP. If you believe the vote should pass, click the green check box Support. If you believe the vote should not pass, click the red x box Reject.

¶ 4. Approve/Confirm your transaction

- After selecting your vote in the step above, you will be prompted to confirm. Then you will be prompted by your wallet to approve/confirm.

Please be advised that the current gas price in the Rootstock network should be in the range of 0.065 GWEI. In addition to this, the gas limit for this voting transaction will be approximately 400,000 gas.

NOTE: Learn more about gas here.

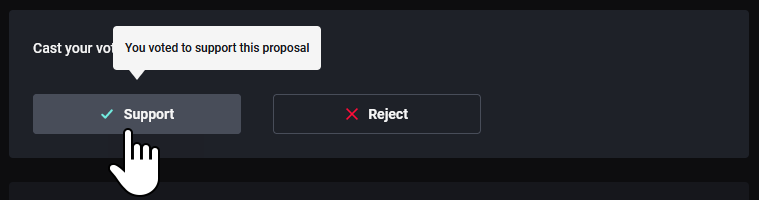

Following your successful voting transaction, the button you selected will change to a highlighted button. Clicking on that button will pop up a message confirming your vote.

Congratulations! You have successfully voted on the Sovryn Bitocracy platform.

¶ Delegating

The Sovryn Bitocracy smart contracts support a feature called delegation that enables stakers to delegate their voting power to another address. Importantly, the address that voting power is delegated to DOES NOT gain the ability to unstake or transfer the SOV in the original address; the delegate address can ONLY submit and vote on Bitocracy proposals using that voting power.

¶ Why delegate?

Delegation is useful for two main purposes:

- You want to keep your SOV transfer authority on one address and voting power on another address. For example, you could keep the private keys with transfer authority in a cold storage address that takes a lot of time and effort to access and maintain the voting power on an address you can easily access from your mobile or desktop wallet.

- You want to delegate your voting power to a third party for some reason, either temporarily or long-term. For example, if a community member wants to submit a proposal that you support but does not by themselves have enough voting power to submit the proposal, then you and other stakers who support the proposal could temporarily delegate voting power to the community member so they will have enough voting power to submit their proposal. Another example is if you want to delegate your voting power to someone whom you consider an expert on the Sovryn protocol, who you think will be a good governor of the system, then you can delegate your voting power long term until you want to either take back your delegation or delegate your voting power to someone else.

¶ How to delegate

¶ 1. Connect your wallet

NOTE: If you have not already set up your wallet to connect with the Sovryn dapp, please visit the Wallet Setup Guide before proceeding.

- Connect your wallet by clicking on the Connect Wallet button on the right top.

¶ 2. Select Earn → Staking

- From the top navigation menu, select the Earn tab and then the Staking option.

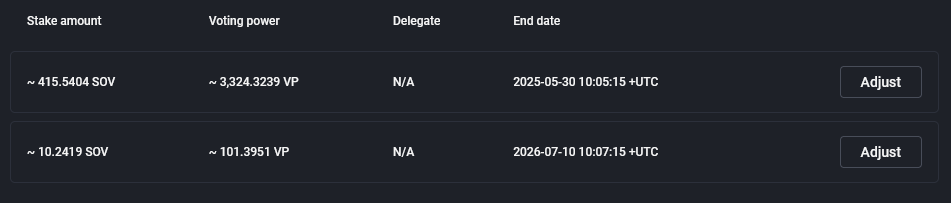

¶ 3. Choose the stake to delegate

If you have staked SOV, the individual stakes will be listed. Select the stake you want to delegate by clicking the corresponding Adjust button.

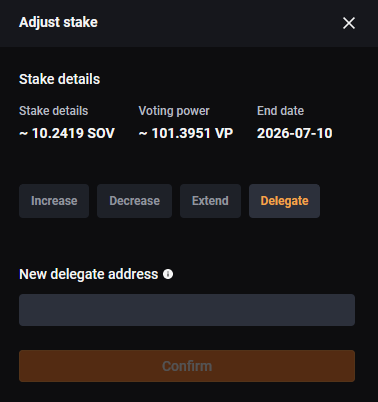

¶ 4. Click the Delegate button

- On the Adjust stake modal, click the Delegate button.

¶ 5. Enter delegate address

- Enter the Rootstock address that you want to delegate your voting power to. Remember, this address will ONLY be able to submit and vote on proposals using your voting power; it CANNOT unstake or transfer your SOV.

- Click Confirm to the delegation transaction, and then Confirm again to confirm the gas. Finally, you will be prompted by your wallet to approve/confirm.

Please be advised that the current gas price in the Rootstock network should be in the range of 0.065 GWEI. In addition to this, the gas limit for this voting transaction will be approximately 400,000 gas.

NOTE: Learn more about gas here.

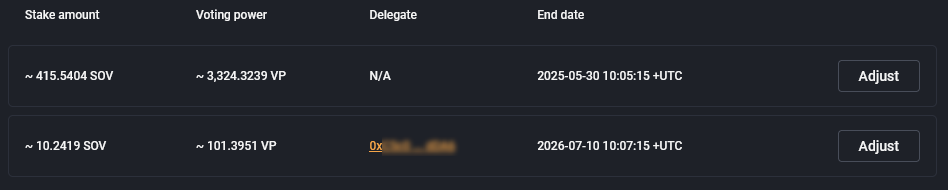

¶ 6. See the address that you have delegated your voting power to

- Once your delegation transaction is confirmed, you can see the address your voting power is delegated to on the main Stake page in your list of stakes.

¶ Revoke your delegated voting power

- To revoke your delegated voting power from an address and return the voting power back to your own address, repeat the delegation process. This time, simply enter your own address as the address that you want to delegate your voting power to. Once the delegation is confirmed, your voting power will be transferred from the previous delegate address back to your own address.

¶ Become a Bitocracy delegate

- Visit the Delegates subcategory in the Sovryn Forum to learn more about how you can become a delegate in the Sovryn Bitocracy.